Are you planning to buy an investment property in 2019?

Or maybe you’re planning to buy a new home?

Well you’ll be in good company because more than half the respondents of a recent survey believe now is a good time to invest despite the fact that the vast majority of respondents (84%) believe that property prices will fall or remain flat over the next year.

Clearly they are taking a long term view.

And 19% of respondents plan to buy a new home in 2019.

In November Michael Yardney’s Property Update, Your Investment Property magazine and onthehouse.com.au surveyed over 1,800 property investors and would be investors for the 2018 Property Investor Sentiment Survey, the largest and longest running survey of its type in Australia

Running since 2011, it offers rich and vibrant insights into how property consumer trends and sentiments have changed over time.

You can download the full survey findings and our analysis here, but here are some of the highlights.

A wide range of Australians – 1,802 ordinary mums and dads responded. The fact that they already subscribed to Property Update or Your Investment Property Magazine meant we had a captive audience of people already interested in property.

When asked for their combined family income 3.4% earned less than $50,000 while 26% earned more than $200,000 but the bulk earned a combined family income between $100,000 and $200,000.

88% owned at least one investment property, but a wide spectrum of investors partook in the survey:

• 12% owned no investments

• 25% owned one investment property

• 19% owned two investment properties

• 15% owned three investment properties

• 5% owned 10 or more properties

Some surprising results:

• 19% of respondents were rentvestors (rent their home but own an investment property, but more than half of the respondents would consider rentvetsing as a way of getting into the property market.

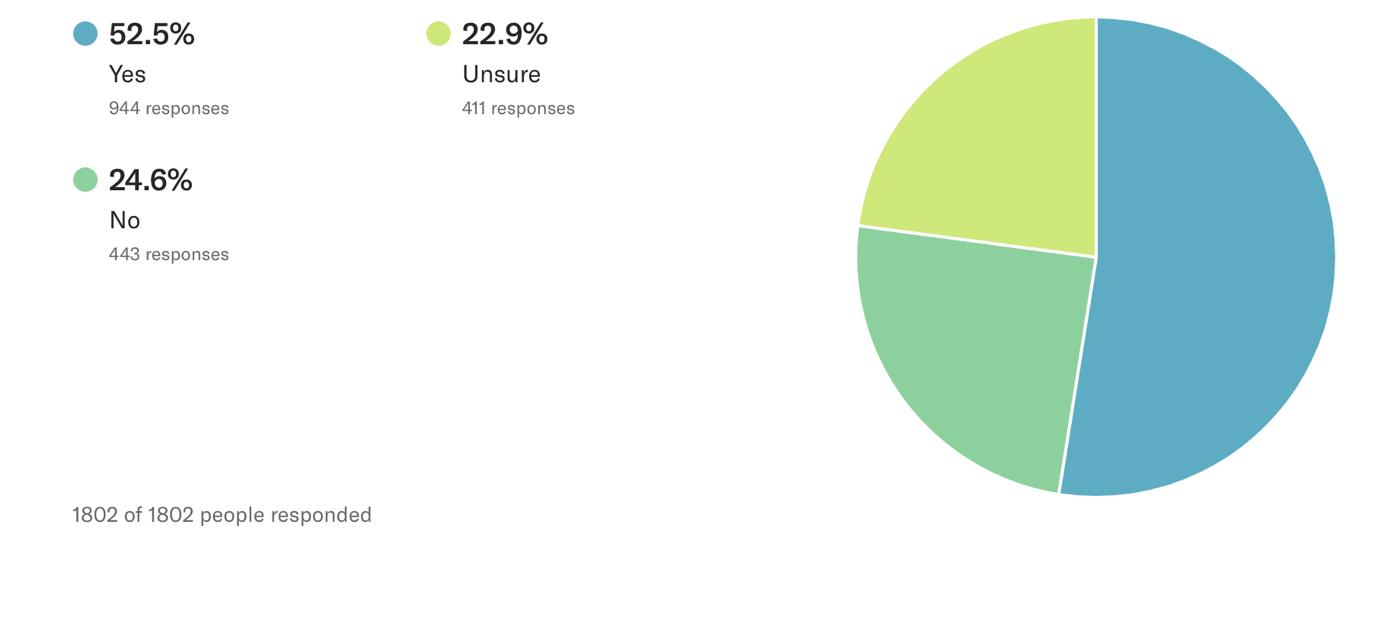

• More than half of the respondents believe now is a good time to invest despite the fact that the vast majority of respondents (84%) believe that property prices will fall or remain flat over the next year. Clearly they are taking a long term view.

However, this is significantly down from last year when 61% of respondents thought it was a good time to invest.

At the same time the percentage that were unsure increased to 23% (up from 16% last year.)

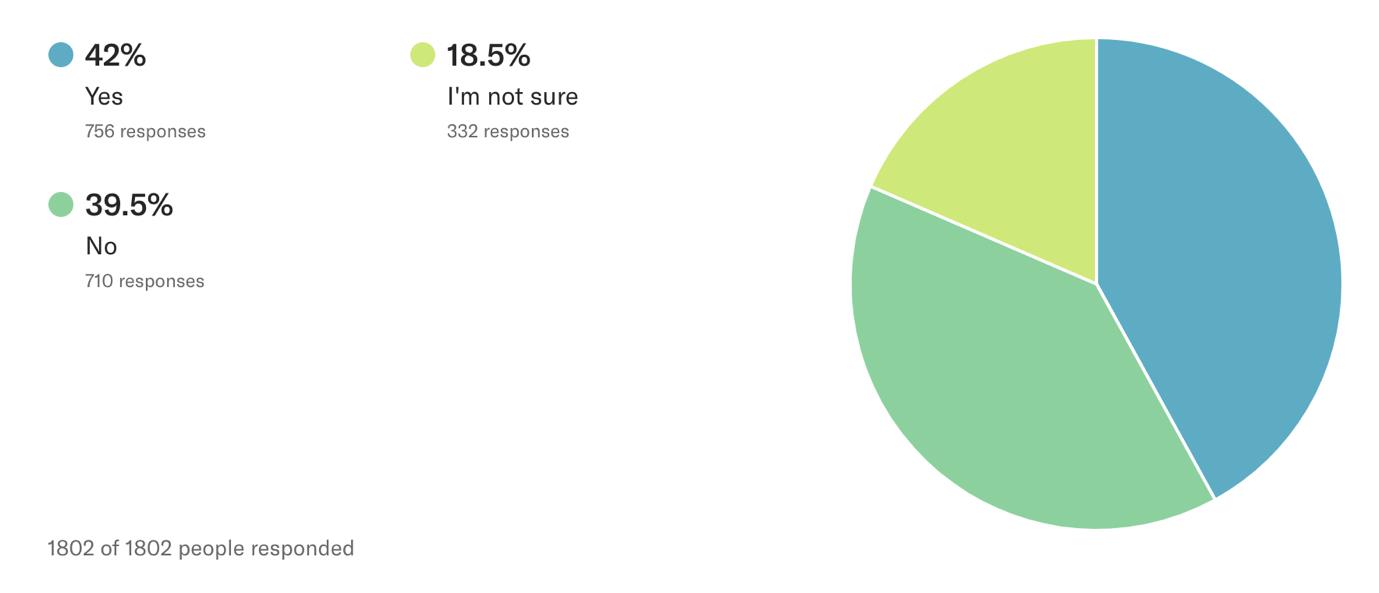

• 42% of the respondents plan to buy an investment property in the next year again showing strong confidence in property as a long term investment.

Not surprisingly this is down from the last 2 years where on both occasions more than half (52%) the respondents were planning to invest in the coming year.

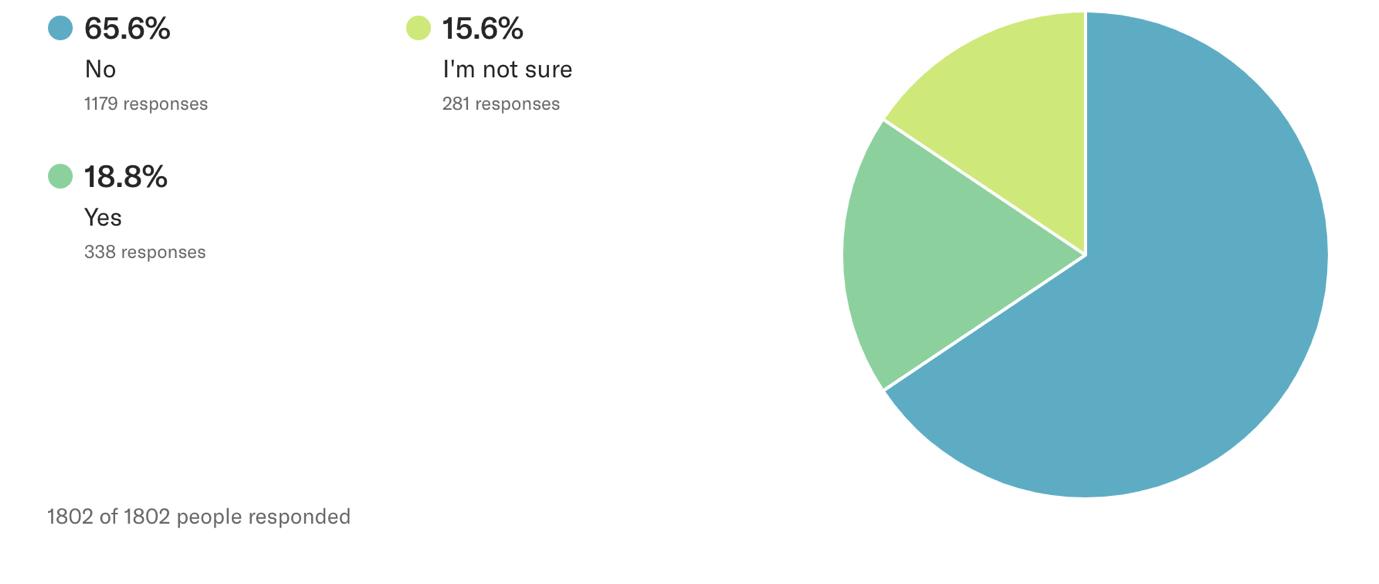

• 19% of respondents plan to buy a new home in 2019.

This is down from 23% last year, but still higher than the number planning to buy a new home 24 months ago (14%)

• While 24% of respondents plan to seek advice from a property strategist or an advisor, we find it surprising that 30% will seek no advice on their next property purchase. This is a concern because, despite the significant amount of research material and information available for free, there’s one thing you can’t get over the internet – and that’s the perspective that only comes after years of on the ground experience.

Some not so surprising results:

• Investors are less confident in short term capital growth than last year. 84% of respondents see property values falling (64%) or remaining flat (20%) in the next year. Last year 64% believed that property prices would remain flat, or increase by less than 5% over the following year.

• Around 40% of the respondents felt it was time to lock in interest rates, suggesting they think that the next RBA interest rate movement will be up. However the concern of rising rates is less this year than this time last year when 46% felt it was a good time to lock in rates

• Almost half of respondents are finding the recent tighter lending criteria impacting their ability to purchase another property. Interestingly this is only slightly higher this year (48%) than last year (46%)

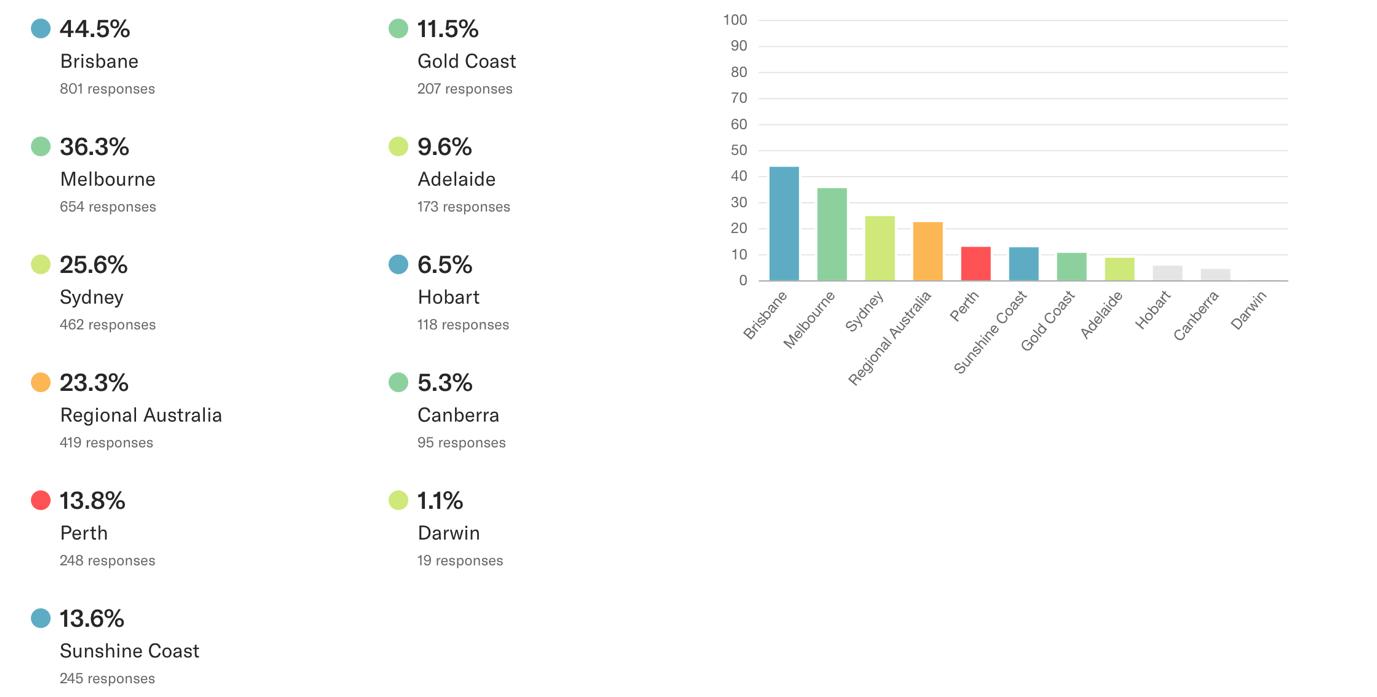

• Brisbane was seen as the most likely capital city to deliver strong capital growth over the next 5 years followed by Brisbane. Note: the numbers in the chart below add up to more than 100% as multiple answers were allowed for this question.

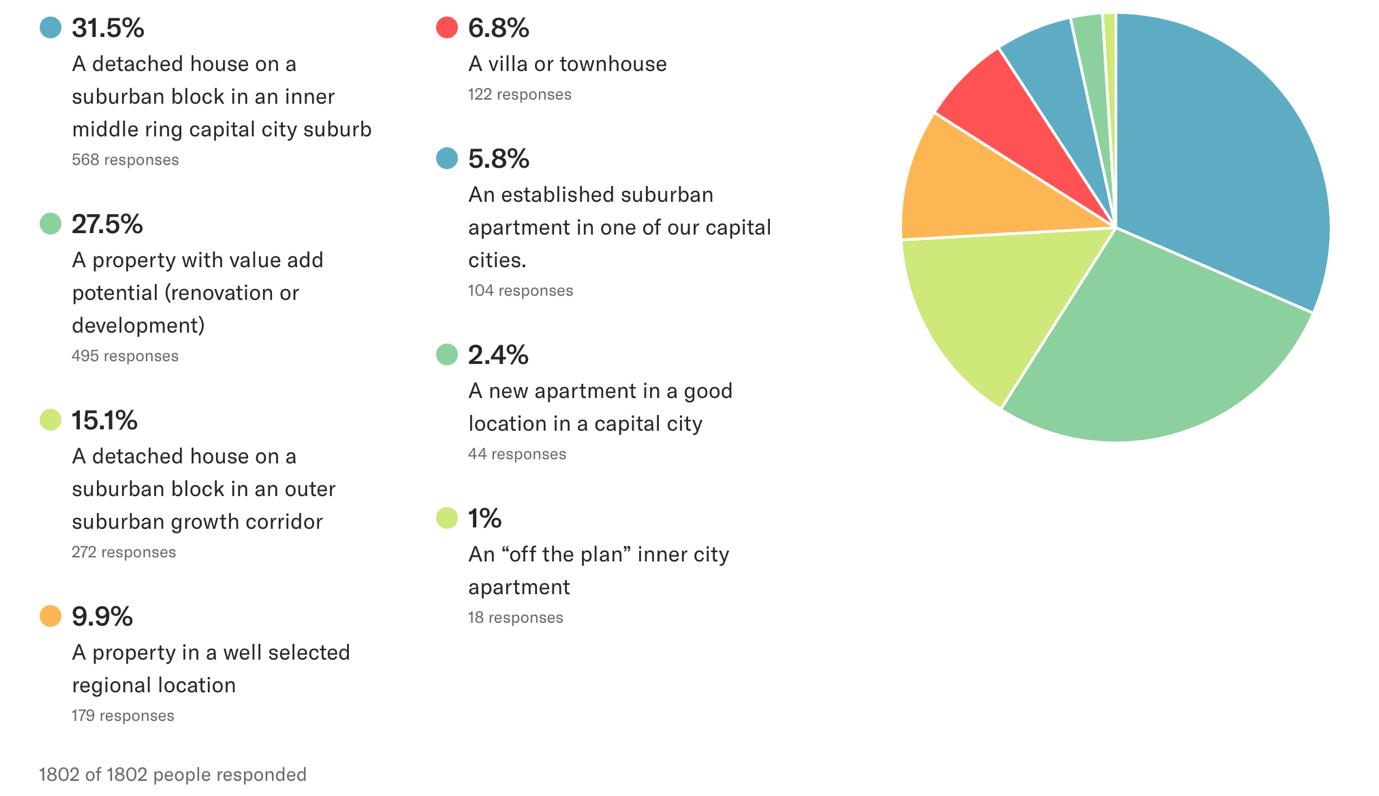

• A detached house in the inner and middle ring suburbs of a capital city was seen as the best medium term investment (31%) while 27% will be looking for a property with the potential to add value. Clearly off the plan properties are out of favour with less than 1% believing they make good investments

• 41% of these investors saw an opportunity to “manufacture” capital growth by purchasing property with renovation or development potential. This is much the same as last year (42%).

It’s clear that property investor confidence is still strong and those who can afford to are planning to remain as active as ever, buying another investment property or new home if finances allow, despite the fact that they do not anticipate capital growth over the next year.

This shows that Australian property investors focus on long-term capital growth, rather than an immediate equity boost, while many are looking for a property that has potential to add value, rather than waiting for the market to do the heavy lifting.