While Australian property investors have enjoyed significantly low interest rates for several years now, their happy run might soon be over. With the Reserve Bank keeping rates on hold over recent months, experts are increasingly pointing to likely rate hikes in the near future.

Specifically, there has been a focus on upping interest rates for both investment loans and interest-only home loans in an attempt to derisk the lending portfolio of the major lenders, while complying with regulatory requirements.

As recently as August, the big banks moved to increase their interest-only home loan repayments by 0.3% on average – in addition to increases that were passed on earlier this year. Similarly, investor rates have also been increased by smaller lenders and non-banks, who are following the big banks’ lead by requiring bigger deposits and enforcing tougher scrutiny of income.

These recent small rate increases are the result of new lending rules imposed by the Australian Prudential Regulation Authority (APRA), which is now demanding that banks cut back on interest-only lending to less than 30% of new loans.

These changes are affecting Aussie property investors, who now find themselves forced to pay hundreds of dollars more in repayments every month. With experts predicting further significant increases in interest rates, this has the potential to hit investors even harder.

Interest rates get a lot of attention and for good reason: they determine the cost of your home loan and what you pay back each month. Even a small rise in interest rates can make a big difference to your repayments. When an investor has several properties in their portfolio, this impact is multiplied.

With this in mind, investors should be bracing themselves for the potential impacts of an evolving mortgage marketplace, by putting effective strategies in place to ensure their portfolio and finances are protected in the case of a further interest rate rise.

I work with many investors and pride myself on staying current in the market, always striving to predict further interest rate rises, and implementing business principles to effectively adapt and respond to these changes.

I work with many investors and pride myself on staying current in the market, always striving to predict further interest rate rises, and implementing business principles to effectively adapt and respond to these changes.

Working with your mortgage broker, you too can get ahead of the game and protect your investment properties from the rising interest rate environment. Following are seven tips for how you can do this.

1 Be open and honest from the outset

I implement a comprehensive screening process for all loan applicants, which allows me to gather crucial knowledge about their financial circumstances.

"Interest rates get a lot of attention and for good reason. Even a small rise in rates can make a big difference to repayments"

The enquiry form given to all clients includes a detailed outlineof information required, and it must be adhered to in order for the loan process to continue. Information and documents to be provided include monthly living expenses, bank statements, as well as details of employment and salary, current assets andliabilities, a full credit history and insurance policies held.

It may sound like a lot of paperwork, but this level of scrutiny has become part of our business policy and has been implemented as a compulsory condition for all of our clients.

It not only gives me the best chance of getting a borrower’s loan approved but also aims to avoid recklessness and oversight – which helps ensure my investor clients attain a modest yet realistic borrowing limit.

2 Factor in a higher interest rate

You may have done all the sums and calculated that you can more than afford the investment property you have your eye on. That’s fine while interest rates are at 4%, but what if they increase to 5%? Or 6%? Or even higher?

The GFC wasn’t all that long ago, and yet people forget that we were all paying upwards of 8% mortgage interest in recent history. When I am working with an investor client, I make sure their borrowing capacity is assessed against an 8% interest rate benchmark. This strategy applies an overcompensation method to ensure all borrowers are covered in case of a rapid interest rate rise.

This benchmark is not an industry requirement and it actually sits higher than most current lender benchmarks. However, I feel it is my obligation to my clients to help them avoid the potential of unnecessary financial stress in the future.

3 Optimise mortgage strategies

With so many different options available to borrowers, it’s important to decide the best plan of attack for your investment portfolio. By utilising both fixed and variable rates in split-style loans as well as offset additions, you may put yourself in the best position to repay your loan or manage your finances more easily, in the event of an unexpected interest rate increase.

"It may make sense to make optional additional payments where possible while interest rates remain relatively low"

Similarly, it may make sense to make optional additional payments where possible while interest rates remain relatively low, to act as a buffer for potential future increases.

This was the case for a couple, Jane and Paul (names changed), who I recently worked with to secure an investment loan. After a couple of years searching, Jane and Paul had found their perfect investment property. They had heard in the media that interest rates were likely to go up in the next few months, and so after I discussed all options available to them we decided to split their investment home loan.

On their $750,000 loan, Jane and Paul decided to pay a fixed rate of 4.19% on $600,000 and a variable rate of 4.38% on the remaining $150,000.

Two months after they settled their new investment purchase, interest rates increased by 0.25% and continued to go up by 0.25% for the next two months. This increased their variable interest payments by almost $100 per month. However, by fixing a portion of their loan, they had saved over $220 per month.

I made sure I explained the risks of this strategy – for instance, had interest rates decreased by 1%, they would have missed out on savings of over $160 per month – but Jane and Paul were willing to take that risk in exchange for some certainty about their loan repayments.

Taking a strategic approach to your mortgages could help you retain flexibility, while also having some certainty and peace of mind about your repayments. An experienced mortgage broker who has a track record of working with investors will be able to achieve this for you.

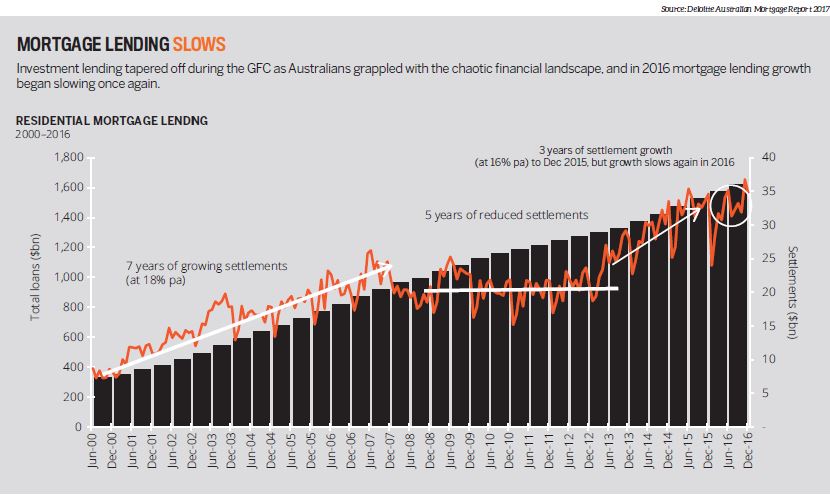

INVESTMENT LOANS RISE

Despite the APRA-led crackdown on investors, growth in investment loans continues to be recorded, showing investors still have an appetite for real estate. ABS Housing Finance data released in August revealed that the total value of investment loans rose by 1.6% in June to $12.5bn, while at the same time housing finance approvals received by owner-occupiers increased by only 0.5%, below market expectations of a 1.5% gain.

4 Seek out opportunities with smaller lenders

In a dynamic economic environment, lenders are being forced to offer highly competitive loan rates. Opportunities exist among many of the smaller lending institutions, and in this market they can offer investors better prospects than the big banks. Being open to these alternative opportunities when seeking lending capacity is essential to ensure you’re getting the best deal.

Remember that the lowest interest rate may not necessarily be the best value, as fees and charges can add thousands to the cost of a loan.

5 Consider your interestonly loan policy

Interest-only loans are highly appealing to property investors and young buyers as they allow them to minimise mortgage repayments in the short term while relying on capital growth of the property in the long term.

However, due to the high-risk nature of these loans, lenders have increased interest rates and will continue to do so with the intention of minimising overall volumes of this loan type. Despite recent rate increases, investors still have a strong presence in the property market: 40% of all home loans are currently held by investors, representing a 4–5% increase over the last 12 months.

While interest-only loans can definitely have their place in your portfolio, be sure to consider all aspects of the equation. When an investor client requests this type of loan, I ask a number of questions, such as: Why are you seeking this type of loan? How do you intend to repay the loan?

Sometimes, the interest-only product is not the most suitable. For example, I know of one investor who had the option of a three-year fixed principal and interest loan (P&I) at 3.99%, or a three-year interest-only loan with the same lender at 4.75%. The loan value was $500,000, meaning the interest-only loan product would cost an additional $3,800 per year in interest repayments!

Ask yourself: does it really make sense to lock in an interest-only loan if the mortgage is going to cost you several thousand dollars more a year in the long run? Depending on your strategy, an interest-only loan could make perfect sense – or it could be worth transitioning to P&I for a better long-term result.

6 Purchase good investment properties

No one intends to buy a ‘dud’ investment property, but some investors do end up with poorperforming properties in their portfolios. When it comes to investment opportunities, buying well in the first place is essential as it means your property will be more likely to see capital growth over the long term.

Just as important, a good-quality property will always be attractive to renters. Thus, if interest rates do rise, the added stress of regularly re-leasing the property (and a potential loss of weekly rental income) will be minimised. You may also be able to increase the rent on a well-sought-after property, which will help offset rising interest repayments.

Factors such as proximity to public transport, good-sized bedrooms, off-street parking, quality of the property, cleanliness and condition are essential.

7 Don’t ‘set and forget’

Many investors can make the mistake of thinking their home loan journey is done and dusted once the loan has settled. I take the view that mortgage management is an ongoing commitment, which is why I keep in regular contact with all of my clients to ensure their financial needs continue to be met.

I offer proactive suggestions to investment property owners on how they can enhance their financial wellbeing in order to create an extra level of security if interest rates rise. These can include tips for minor renovations that create instant equity (such as a fresh lick of paint, or replacing kitchen cupboards or curtains); advice on re-signing tenants every 12 months to guarantee rental income; or simple personal budgeting tips.

"The lowest interest rate may not necessarily be the best value, as fees and charges can add thousands to the cost of a loan"

By offering additional guidance to each of our clients, I’m able to ensure that they are in the best financial position possible to cope with interest rates rises.

Changes to the economy are inevitable, and with a lot of global capital coming into the market we are much more likely to be impacted by external factors that could influence interest rates, among other things. Being proactive about these potential increases by managing your mortgages as effectively as possible will help you navigate the mortgage market and protect you against financial risks.

Mardee Blackwood

Mardee Blackwood

is mortgage adviser at 1st Street Home Loans and

an experienced mortgage broker with more than

15 years in the industry