Your Investment Property magazine's Tom Goodwin sits down with FutureRent's Co-founder & CEO, Godfrey Dinh to find out more.

YIP: What are some of the expenses that property investors need to manage as landlords?

Godfrey Dinh: Property investors need to be prepared for those times when your investment property feels like a big hole in your pocket. Unexpected repairs and maintenance, long periods of vacancy or a renovation are just some of the fi nancial challenges your investment property can throw at you.

Until now, property investors have typically refinanced existing loans or taken out a personal loan when they’ve needed money. Tighter lending standards in recent years have left property investors without a good cash flow solution, as the banks often overestimate expenses, underestimate incomes and ignore other assets, resulting in people being knocked back for loans they can actually afford.

YIP: What problem does FutureRent solve?

GD: FutureRent is a new Aussie fintech trying to solve this problem. It offers property investors early access to up to $60,000 of their rent, paid upfront. The vast majority of Australian property investors are regular hardworking Australians with an investment property as part of their retirement plan. By giving them flexibility with their rent we are giving them greater control over their cash flow and investment decisions.

We’ve helped people buy their next property without LMI [lenders mortgage insurance], give their kids a deposit for a home, and pay for renovations. We’ve also helped people pay for big-ticket items and pay off credit cards and personal loans. By giving people early access to their rent when they need it, we’re also allowing them to be strategic about when they sell.

YIP: How does FutureRent work?

GD: FutureRent users don’t need to provide any income or expense information, and there is no impact on their credit, because they are not borrowing money. Users complete a five-minute online application and are typically paid within two business days. Getting up to $60k without an expensive personal loan should be easier than borrowing $600k, but the banks make it just as painful.

We’re giving property investors a fast, digital and consumerfriendly solution that allows them to unlock their own cash.

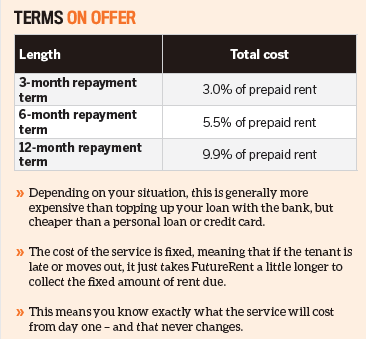

Landlords are paid a lump sum of rent upfront and enter into a type of lease with FutureRent that allows FutureRent to recoup the prepaid rent, plus its fixed cost, from the rent collected. The property manager continues to collect the rent from the tenant and allocates a maximum of 80% of the rent paid by the tenant to repay FutureRent. This allows the landlord to continue to collect at least 20% of the rent to help pay their basic property expenses, such as the property management, strata and water rates.

YIP: How did you work out that this was a pain point for investors?GD: I’m a qualified property economist and real estate investor with 14 years’ experience in property investment and structured finance, including co-founding the boutique commercial property investment and advisory business Sanctuary Partners. I’m also former vice president of commercial real estate at Deutsche Bank in Australia and an associate in Investec Bank’s Property Investment Banking team. I’ve worked with investors of all types for many years and realised that timing is everything and access to cash fl ow can really hold you back.

For more information, call or visit Ph. 02 9358 1556 | www.futurerent.com.au