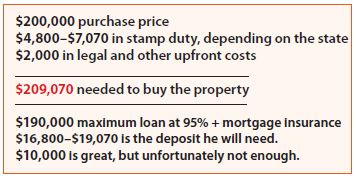

Question: My son is keen to start investing in property, but he’s only 18 years old. Is there a minimum age the bank will lend to? He’s earning around $40k and saved up $10k over the years. What is his option if he can’t get a loan from the bank?

- He continues saving until he has enough.

- You or another relative/person gives him the extra $9,070 he needs as a gift.

- You or another direct relation provides a ‘family guarantee’, which means you put up your property as collateral for the loan and he will not need as much deposit. A family guarantee allows the bank to use some of the equity in your property to help out as extra ‘security’ for their loan.