“I learnt that a bad deal had the potential to derail a property investment game plan and could act as a major setback even for a seasoned investor,” Keshav says. “So I prepared myself to do as much research as possible before I purchased any property.”

“I follow the investment principle of Warren Buff ett: be fearful when others are greedy, and greedy when others are fearful”

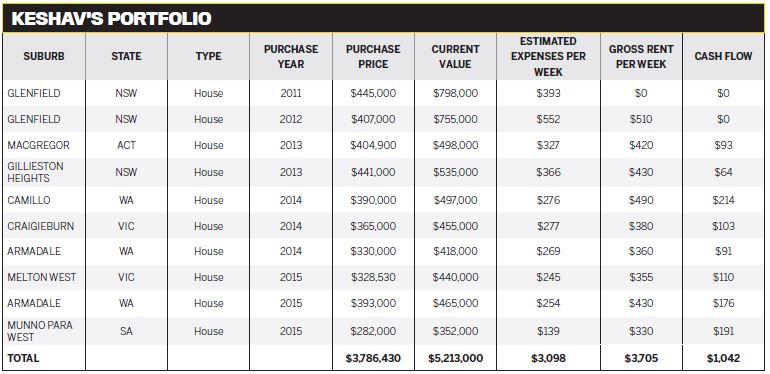

True to his word, Keshav has gained an in-depth knowledge of the property world that would rival that of investors who’ve been living in it for a lifetime.Keshav settled on his first property in 2011: a double-storey, three-bedroom, three-bathroom home in Glenfield, Sydney, that he bought with a $115,000 cash deposit. Testament to his diligent research, the property has grown by close to 80% in value since the day he bought it. Purchased for $445,000, the home is now worth almost $800,000.

But Keshav says the Glenfield property isn’t even his most successful one to date.

In 2014, he bought an eight-month-old four-bedroom house in Camillo, Perth, from a highly motivated seller.

“The fi nal purchase price was negotiated to $390,000, which was nearly $30,000 less than the original asking price,” says Keshav. “That resulted in an instant equity gain. It’s grown in value by about $100,000 in the last two years.”

Benefiting from a buy-new strategy

Keshav explains that he opts to purchase new or off-the-plan dwellings, which allow him to profi t from any equity gathered from the time of purchase to completion. He looks for detached properties in growth corridors across Australia, and prefers lot sizes from 300sqm to 800sqm. The larger lot sizes give some wiggle room down the track to demolish the existing home and construct multiple dwellings.

“New buildings have higher depreciation and are less susceptible to maintenance issues,” explains Keshav. “However, it is vital that each property I purchase was built by a good and reputable builder.”

He has another trick up his sleeve when it comes to building from scratch. Keshav says he avoids progress-payment builds and instead opts for a 5% or 10% deposit up front, and the rest on completion. “This allows me to save significant money on mortgage interest payments, and also on stamp duty, depending on the state and purchase type,” he says.

Other attributes that he looks for are a purchase price of less than $600,000 – and which is not more than the median house price for the suburb.

“I look for properties within 10 to 40km of the major capital cities and in growth corridors,” says Keshav.

“Communities that attract families make tenants that generally stay for a longer duration. I avoid buying units because the land component is negligible for units and apartments, and strata fees reduce the net rental income.”

And of course Keshav strongly suggests doing your homework before purchasing. “Conduct extensive economic and demographic research, and do the number crunching to evaluate the suburb and the property’s current and future prospects,” he advises.

Buying now for the future

Keshav has adopted a diverse and diligent strategy, which has clearly impressed our judges. And it all began in 2011, when Keshav, an information technology teacher, says he realised that the superannuation he and his wife, Ishpreet, had accrued, together with their pension, would not be enough to support them comfortably through retirement.

Since then, Keshav has focused his strategy on buying and holding for capital growth.

“We also want to be able to support and fund my two daughters’ education so that they can become able and contributing human beings when they grow up,” he says with a smile.

And while his eye is firmly on the long-term prize, Keshav is finding that he’s already able to live more generously, courtesy of his careful planning and burgeoning portfolio.

“I’m very humbled that my property investment is helping me to increase the number of charities I support,” says Keshav, who has been a long-time supporter of charities like beyondblue, the Royal Flying Doctor and Save the Children.

“The more I invest, the more I will be able to support various charitable causes,” he adds.

Closer to home, Keshav has become a personal mentor to other aspiring investors, helping four friends to purchase properties of their own.

“I’m passionate about helping others, and I really like to teach,” says Keshav. “I feel so fortunate to be in a position where I can help other people to become savvy investors.”

Creating capital growth

To maximise the potential capital of each one of his purchases, Keshav has defined a set of characteristics that he looks for in his properties. Firstly, he targets properties that can be improved through minor renovations.

“For example, I would prefer a house with two lounges, so I could convert one lounge into a bedroom by adding an additional door and internal wall,” he explains. “This minor change maximises the rental yield and can fetch anything from $30 to $50 extra per week in rental income.”

“Currently I’m predominantly buying in and around capital cities in Western Australia, Victoria and South Australia,” says Keshav.

A numbers man through and through, Keshav says he creates a shortlist of suitable suburbs based on his demographics research.

“I keep investigating suitable properties, and depending on where I find an investment opportunity first, I buy there.”

A safety net for risk

Keshav adopts a three-pronged strategy for avoiding risk: diversity in location, well-managed mortgages, and asset protection.

“I believe buying properties in various states helps me to benefit from each state’s own property cycle,” says Keshav. “Also, if one state is doing well and property prices are up, there’s an opportunity to use the increased equity from my properties in that state as a deposit. Then I can focus on buying more properties in states with good potential that are currently experiencing a subdued economy.”

Next, Keshav uses a range of financial tactics to keep risk at a minimum. He uses a variety of lenders to maximise his borrowing power and avoid having all his funds tied up with one institution.

He also avoids cross-collateralisation of his loans. “If properties are cross-collateralised and the value of one property goes up and another goes down, the net effect on both properties’ performance has to be accounted for while drawing out the equity,” he explains.

As a result, one poor performer can stifle the available equity on all linked properties.

To reduce the impact of fluctuating interest rates, Keshav says he uses fixed-rate loans with a term of one to three years.

“I also use a split-loan facility, where half of the loan is fixed and the other half is variable. Consequently, I have interest rates ranging from as low as 3.90% to as high as 4.7% across my portfolio,” he says.

“I’ll still keep fine-tuning my own property investment strategy and philosophy over time. Your Investment Property magazine has helped me a lot by reading about other investors’ mistakes!”

A focus on equity boosts buying power

Although he started with a decent deposit of $115,000, Keshav’s successful strategy of chasing quick capital growth means he has had plenty of equity to fund all his purchases since then.

“Using the current equity growth in my portfolio, I have been able to unlock close to $244,000, which can be used for deposits to purchase multiple properties,” he explains.

“Due to this equity growth, my portfolio value has grown approximately 60% since 2014.”

In fact, in the two years to 2016, Keshav’s portfolio increased from $3.27m to $5.21m.

But this doesn’t mean he plans to slow down now. Keshav says he and Ishpreet intend to own a property portfolio valued at up to $50m eventually, encompassing several dozen properties. And judging by his success to date, it looks like their future is likely to pan out just the way Keshav has carefully and meticulously planned.

Congratulations, Keshav, our 2016 Investor of the Year.

KESHAV’S TOP 4 SUBURBS TO WATCH

1. Armadale, Perth: “It ticks all the boxes as a promising suburb, based on its current economic barometer, infrastructure development and demographic forecast.”

2. Melton, Melbourne: “When compared to Australia's average annual population growth of 1.6%, Melton’s expected growth is nearly 430% higher and is certainly something to think about in terms of future prospects."

3. Craigieburn, Melbourne:

“Craigieburn is well serviced and people can easily commute to Melbourne via rail, bus, freeway and highway for work daily."

4. City of Playford, Northern Adelaide: “Although comparatively City of Playford has lower forecasted growth, it still ticks all the boxes as a vibrant suburb with good potential for future capital gains and high rental yield, based on its current state of economy and infrastructure development.”

MY ONE PROPERTY REGRET

While he’s thankful that his portfolio is performing well, Keshav says his one regret is that he didn’t start earlier. “I wish I could turn back the clock and start investing in properties when I was in my 20s,” he laughs. “At the same time, I think that it’s still okay to invest now, as the interest rates are at record lows, so it’s a good time to be investing.”

– Elvio Bechelli

– Tim Lawless, CoreLogic

– Tyron Hyde, Washington Brown

CAPITAL GROWTH SNAPSHOT

Property 1: Glenfield, Sydney, NSW

3x3 house, double-storey

Capital growth: 79% in last 5 years

Purchase price: $445,000

Current value: $798,000

Property 2: Glenfield, Sydney, NSW

3x2 house

Capital growth: 85.5% in last 4.5 years

Purchase price: $407,000

Current value: $755,000

Property 3: Gillieston Heights, Hunter Valley, NSW

3x2 house

Capital growth: 21.35% in 3 years

Purchase price: $441,000

Current value: $535,000

As the winner of the 2016 Investor of the Year Award, Keshav receives an amazing prize pack worth $10,807, including:

- $1,000 eftpos® card from DHA Australia

- $1,000 cash from Multifocus Properties & Finance

- A 12-month subscription to CoreLogic’s RP Data Professional

Investors Package, which offers subscribers unlimited insight into every available property, street, suburb and state in Australia. Valued at $2,340 each

- A full 12-month membership of Real Estate Investar’s Portfolio

Builder, allowing subscribers to manage, track and optimise their

portfolios’ performance with powerful and easy-to-use tools, valued at $2,988

- A platinum 12-month membership of NMD Data, the online property

listing website that exclusively lists mortgagee foreclosure, deceased estate and housing authority properties. The only comprehensive national database of its kind in Australia, valued at $199

- A selection of schedules, including a Residential Depreciation and Cost Plan, or Sinking Fund or Insurance Report, from Washington Brown Quantity Surveyors, valued at $2,360

- A 12-month subscription to Your Investment Property, and a selection of our bestselling special reports and e-books, valued together at $889.85

- A copy of the bestselling book, The Armchair Guide to Property Investing, by Ben Kingsley and Bryce Holdaway