Growing up in northeast India, Keshav Jha was always fascinated by the opulent palaces and mansions scattered around the landscape. As he listened to his grandfather’s tales about these grand architectural masterpieces, he dreamed of one day owning property.

Those dreams were put on hold as he and his family struggled to ensure he received a good education. This focus paid off and he eventually earned a master’s in information technology from Ballarat University. But any dreams of property ownership were consigned to the backburner along the way.

Several years later, Keshav welcomed his first daughter into the world. And, as with many new parents, he experienced a rush of simultaneously exhilarating and overwhelming emotions

His intense desire to give his daughter the most promising future possible has consumed him. “My wife, Ishpeet, and I believe education is of paramount importance for that. But I also realised that the cost of education s getting more expensive as time goes by,” he says.

At the same time as Keshav startedworrying about his daughter’s future education costs, he discovered what the average annual retirement income was in Australia. After doing further number crunching, he realised that superannuation would not be enough to pay for a comfortable lifestyle in retirement.

“These realisations had a profound impact on me: I started worrying about what I could do to better fund my family’s future. Doing research into investment options led me to decide that the best way to get wealthy quickly with limited risk was through property investment,” he says.

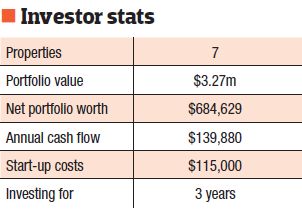

This prompted Keshav to embark on his investment journey in 2011. That decision is already paying dividends. In three short years he has built up a seven-property portfolio worth $3.27m. As further icing on the cake, the way he has gone about doing this has led to our judges’ decision to award him a Highly Commended place in Your Investment Property’s Investor of the Year 2014 Awards.

How the journey started

Once Keshav decided that property was the way forward, he got to work preparing himself for the journey. First he did some detailed goal setting for the next 10 years. He then embarked on an intensive self-education program that involved learning about strategy, selection criteria, terminology, and the stories of other investors.

As a teacher, he enjoyed reading and researching – and had the skills to do so effectively – and this helped him learn the basics of property investment quickly. “I decided to invest like professionals do and to treat property investment as a profession. Ongoing learning and comprehensive due diligence are critical to this. So I decided I would always do as much research as possible before I purchased any property,” he says.

Based on his research, Keshav also formulated an investment strategy that he felt was best suited to his needs and risk tolerance. He decided to focus on accumulating new residential properties in good locations around Australia.

The properties he invested in would have to provide a decent rental yield and be positively geared. Ideally, they should be brand-new properties in growth corridor areas within 10km to 40km from a major capital city.

Further, he wanted detached houses that maximised the land component and could provide healthy depreciation benefi ts due to the new building.

Armed with his goals, strategy and research, Keshav started looking for his fi rst property in 2011. Using $115,000 of his savings as a deposit, which allowed him to get a 75% LVR loan with ME Bank, he purchased a three-bedroom house off the plan in Glenfi eld, NSW.

As he and his family had been renting, their first property became their principal place of residence. But he had chosen the area carefully and was confident growth was on the way. This would enable him to leverage equity in the house for further investments in the future.

How Keshav selects his investment properties

Since that first investment, Keshav has essentially bought a new property every six months, and he now has seven properties. While he has stuck to the strategy he developed when starting out, he has become more adventurous.

For example, he has branched out from NSW into other states (ACT, WA and Vic). Investing interstate allows him to benefit from the land tax threshold and also ensures diversification of properties in his portfolio. Keshav has also moved into adding further value through renovation, by creating extra bedrooms in two of his properties.

However, he continues to swear by off-the-plan purchases. “This is because buying off the plan gives me the opportunity to be more disciplined with my savings. It also allows me to develop an investment mindset which teaches me to forego immediate gratification for the future rewards of capital growth,” he says.

To ensure he consistently buys quality properties that meet his criteria, he created a rigorous checklist as part of his research and due diligence process. This included:

- Conduct extensive economic and demographic research and crunch the numbers to evaluate both the suburb and the property’s current and future prospects. Buy properties under $450,000, and avoid buying over the median house price in any suburb.

- Buy properties with easy access to good infrastructure such as public transport, shopping centres, schools, parks, and highways.

- Look for properties in planned communities that are likely to attract families as prospective tenants. Families tend to stay put longer as they want stability in their family life.

- Always check the area’s current zoning and development restrictions with the local council, and verify whether a property is located in a flood zone or a bushfire-prone area.

- Avoid buying units or apartments, because the land component is negligible. Also, strata fees in high-rise blocks with lifts, a gym and a pool could reduce the net rental income derived from the property.

Finance strategies

When it comes to finance, Keshav has also devised a set of lending strategies that he abides by. These include:

- Use multiple lenders and cap borrowing with each lender at a maximum of $1m. Lenders tend to treat million-plus borrowers as high risk, which can impact on borrowing capacity. This isn’t the case when loans are spread across different lenders.

- Avoid cross-collateralisation of properties. One underperforming property could risk another property that performs well. Also, if properties are cross-collateralised, they all need to be revalued to access the existing equity.

- Go for higher-LVR (90–95%) loans to maximise deductions and minimise the amount of money required for the deposit.

- Choose loans with interest-only terms of three or five years to keep the repayments to a minimum.

- Keep tabs on your credit file with a subscription to Veda credit reporting. Unexpected changes to your file could impact on future approval of loan and credit applications.

Along with lender diversification, which minimises the risks associated with having everything tied up in one financial institution, Keshav focuses on a comprehensive asset protection and risk management strategy, including:

- Always have income protection insurance. “All my properties are either neutral or cash flow positive. But having income protection insurance means you are prepared in case something – like an illness or disability – happens. It means you can still meet loan repayment obligations, and provides peace of mind.”

- Always get landlord insurance. “There is a risk that you will encounter bad tenants. Landlord insurance means you can deal proactively with challenging situations, for example if a tenant trashes a property or leaves unannounced while still heavily in arrears.”

- Establish a discretionary trust structure. “The main benefit of a trust is that, in cases of debt enforcement action or bankruptcy due to litigation, the assets in which you have an interest via a trust will be protected.”

- shops around for the best possible interest rates

- negotiates the terms of the loan, and the interest rate, to improve cash flow and minimise loan repayments

- uses a split-loan facility, which means half the loan is fixed while the other half is at a variable rate (Consequently, he has interest rates ranging from as low as 3.99% to as high as 4.74% across his portfolio)

- aims, with fixed interest rates, to lock in a loan term from a minimum of one year to a maximum of three years

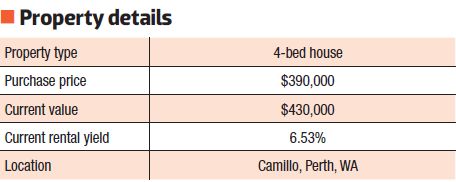

It is a detached, single-storey, double-brick four-bedroom house that was built by a well-regarded Perth builder and has a lifetime structural warranty.

The property also had the bonus of being already tenanted (at $490 per week).

Finance

Originally, this property was listed at $419,000. However, Keshav offered $390,000 as he knew the vendor was highly motivated to sell and needed money for another project. His offer was accepted.

Based on his financial circumstances at the time, he chose IMB Bank as his lender. In his view, IMB offered personalised service and a great interest rate of 3.99%, with the added benefit of lender diversification.

To finance the property, he used the equity in his fourth property to get a loan of $48,000 from ME Bank. This, along with some savings, allowed him to purchase the property at 90% LVR.

Thanks to a rental yield of 6.53%, the property was set to be cash flow positive by around $5,000 annually after expenses.

Additionally, as there was an existing tenant, it was not necessary to pay letting fees to the real estate agency doing the property management post-settlement.

Research

In a bid to diversify his portfolio further, Keshav researched the WA market and targeted Armadale for his purchase.

His research showed that this suburb had a high population growth rate. The average annual growth rate is currently 4.4%, but it is forecast to grow at an even healthier rate of 4.94% for the next 17 years.

Besides the strong demographic data, Keshav’s research showed that Armadale also had good amenities and infrastructure and development projects in the pipeline.

Further research led him to the Camillo property, which had “all the bells and whistles and ticked all the boxes of my investment strategy”, he says. For example, it had easy access to the Perth CBD, along with direct links to the area’s main highways.

Keshav, who is a firm believer in listening to your heart, adds that all the numbers stacked up well, but his gut instinct also told him it was right.

Performance

That gut instinct proved to be spot on. Not only did the property have an instant equity gain of $30,000 (due to the discounted price negotiated), but with a rental yield of 6.53% it was cash flow positive. The fact that the existing tenant stayed put meant there was no break in cash flow.

On top of that, there have been no challenges or problems associated with the property. In fact, it has been such a success that Keshav is refashioning one of the existing entertainment areas to create a fifth bedroom. This should increase the rent by about $30 per week.

He has no intention to sell the property any time soon. “I plan to hold the property for at least 20 years, reaping healthy capital growth and cash flow. I also plan to use equity growth in the property down the line to fund future property purchases.”

Moving forward

Keshav says he has been fortunate not to have made any major mistakes or experienced any setbacks to date. He is aware that he could possibly face these in the future, but it won’t put him off property investing.

“I believe as a part of my life’s philosophy that whatever happens, it happens for a good reason, and no matter how negative a situation might appear, it still ends up serving us. If we make a mistake, we will learn from it to become a better investor.”

His only regret is that he didn’t start investing in properties earlier. “The benefit of having more time on my side would have had the potential to increase my portfolio value a lot more than it is currently.”

However, he is firmly on the property investment road now. And his Investor of the Year award only serves to reinforce the wisdom of that course.

“Keshav is committed to a long-term advanced property investment strategy. I’m very impressed with his four key asset protection methods: 1) avoiding cross-collateralisation, 2) income protection, 3) landlord insurance, and 4) setting up a trust. Investing in property is hard; however, keeping and protecting your assets is even harder … Your family depends upon it.”

– John Kovacs, managing director, NMD Data

“I love that Keshav has taken to self-education, obviously a spin-off from being a teacher. His strategy is solid: buying new properties in good locations across different states to maximise different cycles and tax deductions. Though the portfolio is quite young, it will mature nicely in the next 10–15 years.”

– Ed Nixon, CEO Trilogy Funding

Keshav wins

For winning a Highly Commended ranking in Your Investment Property’s 2014 Investor of the Year Awards, Keshav receives a prize pack worth $1,956, including:

- A 3-month Real Estate Investar ‘Portfolio Builder’ membership, valued at $747

- A 12-month NMD Data ‘Platinum’ membership, valued at $199

- A 12-month subscription to Your Investment Property magazine, including an exclusive report pack compiled by Your Investment Property and RP Data, valued at $1,010