Now embarking on her 59th renovation project, Cherie continues to rack up fantastic profits.

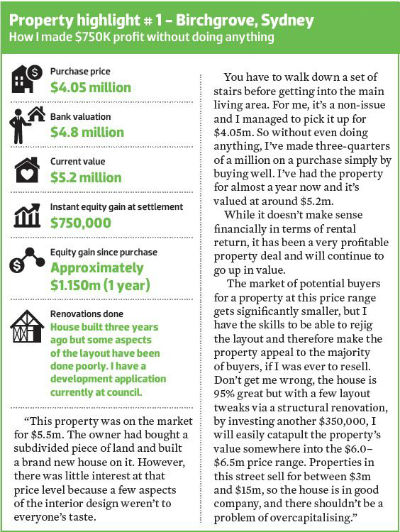

She has successfully built her property portfolio to a point where she has finally been able to buy her dream homes: a Sydney harbour waterfront home in Birchgrove, Sydney, and a beach house in the exclusive enclave of the Wategos in Byron Bay.

Both properties are currently worth a combined value of $8.8m. Cherie’s hard work over the last 24 years has certainly paid off.

“As investments, these two properties make absolutely no sense as they are very negative cash flow, but these are not about cash flow anymore because I’ve already got that with my other investment properties. It’s now about lifestyle. It’s about being in a place or places where you want to be and spend your days off there, and I’ve used my property portfolio to fulfill those personal goals. I have recently disposed of a number of properties in my portfolio so I could consolidate those sale proceeds to buy these particular homes.”

Just like many successful property investors featured in Your Investment Property magazine, Cherie began with little money behind her.

What she had was the willingness to work hard and the determination to succeed. And succeed she did. During the past 24 years, she’s been involved in over $50m worth of property.

She quit her full-time job just after her first renovation project, leading her to work full-time as a professional renovator. She’s become Australia’s most sought-after renovation expert in the media, is a regular cast member on Network Ten’s The Living Room and has her own renovation shows in Australia and the US.

Cherie’s formula for success

Over the last 24 years, Cherie’s strategy has remained deceptively simple, yet proved to be extremely lucrative for her and for those she has mentored.

“My strategy has been to acquire unrenovated properties that I could manufacture equity either as a cosmetic or structural reno. By doing this over and over again for the last 24 years, I’ve benefited from the compounded capital growth and immediate profit from each renovation. My portfolio has grown enough in equity that it has enabled me to buy more unrenovated properties, as well as my dream homes.”

When it comes to renovation, Cherie believes in sticking to a proven formula to maximise your profit. This involves following a set of criteria, from deciding which suburb to buy right down to the colour of paint she’s going to use in her renovation.

By using what she calls a cookiecutter approach, you minimise your costs, maximise your process efficiencies and exponentially boost your reno profits.

“I think a cookie cutter template is the most lucrative way to do your renovation,” she says. “This means all my reno projects have the same look and feel, just a different address. This is the smarter way to renovate. I don’t try to create a different look for every project. I’m not out to win awards and be on the cover of design magazines. I’m out to make money. I adopt a production line mentality in order to extract the best profit from each property.

“A cookie cutter approach means that all the internal colours for each property are the same, as is the way the cabinets are installed, the type of benchtops to use, right down to the way the tiles are laid. Everything follows a strict formula. When you have a production line, any leftover materials go straight to project number 2 and so on. You can also cookie cut your tradie team. My tradies know what to do and how I want to do things. I don’t even have to be there to supervise them all the time.”

Cherie also believes that holding on to your property is key to succeeding as an investor.

“The only time you sell is when you want to round up cash flow for another purpose, be it property or something else. Unless there’s something negative happening in that suburb that would adversely affect your property value, I’d advise not selling. The only other time I’d advocate selling is when you’re ready to execute your exit strategy once you’ve built your portfolio to a critical mass.”

Cherie did just this with her Birchgrove and Wategos properties, where she sold a number of other property assets in order to buy these lifestyle properties.

“Up until now, I was in equity building mode and was happy not to have my dream home. But recently I sold some properties so that I could buy two that are geared more around lifestyle than financials. My Byron Bay property is rented as serviced accommodation so whenever a tenant is not there, I can use the property for lifestyle, while at the same time it’s a great property for tax minimisation due to the negative cash flow.”

What’s on my shopping list?

While some of Cherie’s renovations focused on the more affluent inner west suburbs of Sydney, she also has a number of properties located in the middle to outer fringe suburbs.

Cherie believes that demand is strong in these areas and they offer

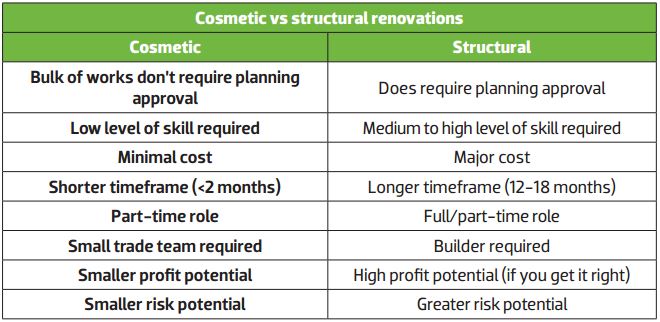

many opportunities to do cosmetic renovations. They’re also relatively affordable compared to the inner west. “I’m looking for more cosmetic renovations. I made a decision to exit structural renovations after I finished my last structural reno project in mid-June. While this was a very profitable renovation, I like doing cosmetic renos more now because it’s faster and easier. You go in and you get out very quickly. I’m a big believer in keeping it simple as there are fewer things that can go wrong. Logistically, they are a lot less complex, too.

“Cosmetic renovations are a nice easy transition for anyone looking to become a full-time property investor. People can easily stuff up a development project, but it’s hard to stuff up a cosmetic renovation,” says Cherie.

CHERIE’S TOP TIPS FOR CHOOSING THE BEST SUBURB

Whether you’re renovating a property to hold or to sell, buying in the right area and the right property at th

“You ultimately want to select a cluster of one to five suburbs, preferably located close to each other. This will ensure they share similar demographics and features, as well as the same local council, which will make your job of researching a whole lot easier,” she says.

“Consider looking along the transport corridors: those with excellent road and rail connections to the CBD. The combination of affordability and an easy commute to work will ensure ongoing demand for a suburb.”

CHERIE’S 10 TIPS FOR MAKING AMAZING RENO PROFITS

1. Kitchens and bathrooms offer the best value-adding opportunities, so focus on creating large, practical spaces

2. Aim for open-plan living

3. Remove walls that are not load bearing to create the illusion of space

4. Style your property with chic accessories, eg rugs and plants

5. Stainless steel appliances have greater perceived value than white

6. Convert under-utilised space(eg a formal dining room) into an additional bedroom

7. Add a second bathroom in houses with four or more bedrooms

8. Repaint the interior in light, neutral colours

9. Cement render external bricks

10. Add a granny flt to large blocks

“The scope of works was a major structural renovation converting the original property from a single level, 2-bedroom, 1-bathroom house to a 2-storey, 4-bedroom, 2-bathroom + study family home.”