15/03/2018

Like many Australians, Travis Lambe and his wife, Connie, were interested in property investing as a way to build their wealth while they worked hard to pay off their home and save for retirement.

“We had paid down quite a bit of the debt on our home, and we had a reasonable amount of equity and were looking for an avenue to improve our wealth for the future,” Travis says.

The pair looked at investment options like shares, but it was property that got their attention.

“The stock market seemed like even the fundamentals were complex, and we didn’t understand it. Property seemed to make sense to us. Although there are lots of complexities and lots of things to learn, that fundamental of supply and demand is easy to comprehend.”

The capital growth in their own home that the couple observed helped spur their decision to enter the property industry as investors. They did not begin their journey alone, turning to property investment firm OpenCorp for guidance.

“We did our research on where to start, and we

were fortunate that we had good friends who were involved in property investing, so we sought expert help,” Travis says.

They sought advice on property investment strategies and reviewed various properties they could invest in, before picking their first investment property – a house in Greenvale, Victoria.

Years investing: 2

Current number of properties: 2

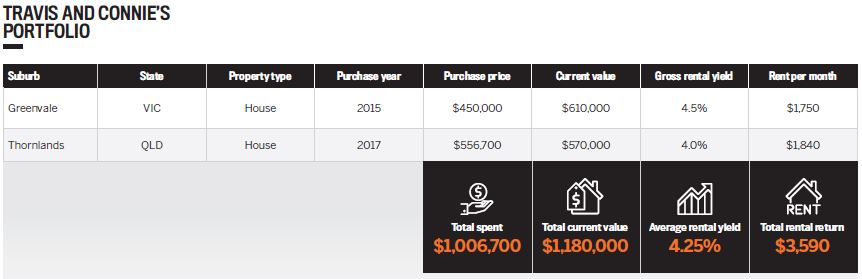

Portfolio value: $1.18m

Strategising for capital growth

Travis and Connie decided that they were most comfortable with a strategy that focused on capital growth rather than cash flow. With that in mind, they determined that they would aim for new house and land packages within pre-existing suburbs in an infill area. They would also endeavour to secure these properties for below the median house price.

In addition, the Lambes also chose to broaden their horizons by extending their search to other states and cities, rather than staying close to home. As interstate investors, they paid attention to each state’s property cycle movement and opted to focus on suburbs in capital cities in order to maximise growth potential.

The Greenvale home was selected based on this strategy and is the Lambes’ most successful deal to date.

“Less than 18 months on, the property is valued at the median house price, which is 35% capital growth compared to our purchase price,” Travis says.

This experience showed the couple how property investing can generate the kinds of results that would have taken them years to achieve through saving alone – and prompted them to dive into their second investment.

Their search this time led them to Thornlands, a suburb about 28km from Brisbane’s CBD. Less than a year ago, they paid just over $550,000 for the property, which now rents for $425 per week.

Cash matters

The Lambes say their goal is not to get rich quickly but instead to grow their wealth over a long period of time. As they plan out the purchase of their third investment property over the next 12 to 18 months, they are looking to stay smart and keep their financials in check to minimise risk.

“We make sure we can service the debt. Before we buy or, more specifically, borrow, we presume the interest rate is double what it currently is, then do the math [to see] if we can afford that. Once the answer is yes, we look to buy the

right property,” Travis explains.

He and Connie learned to monitor their money while investing, as a result of the experience of their first purchase.

“The first time around it was very new to us; we thought we had been quite conservative and allowed ourselves enough buffer. But given we had decided to buy land and build, that made it quite a long process.”

Crunch time happened near the end of the construction process, after they had already forked out money for the land and the progress payments to the builder – and they still had no rental income flowing in.

“When you get close to the end, you’re nearly covering the full debt but you’re still not receiving rental income from tenants. Things became really tight for us, and we realised we should have allowed a little bit more to get us through that final stage,” Travis says.

The Lambes learned their lesson and kept more cash in reserve when they made their second property purchase in 2017.

At present, the couple’s property investment portfolio has already added around $170,000 in net worth to their finances, and they have only been in the game for two years. The passive income they are generating has helped to ease the pressure of having to prepare for their future.

“Had we used that extra money to purchase and hold investment properties instead, we would have been much better off”

“Now and in the future, it will allow our children a life we potentially couldn’t have afforded, had we not invested in property. It will enable us to have more wealth to provide them with a better education, better living environments and lots of creature comforts in life,” Travis says.

Their one regret is a common one: they wish they could have started investing earlier, which would have increased their potential for profit.

“We spent many years working really hard and paying extra off the mortgage of our home, which was a great thing to do and got us to where we are today. However, had we used that extra money to purchase and hold investment properties instead, we would have been much better off.”

But Travis and Connie choose to not dwell on the past and want to begin instilling in their children the values they have learnt on their journey.

“Property investment will teach them a good, real life lesson in managing their own finances when the time comes: that if you sacrifice and work hard today, delay your own gratification and spend the money that you earn wisely on something that will make you more money, then long-term you’ll be able to afford all the things you might want in life,” Travis says.

“We try to teach them the same concepts and put things in their language. For example, it’s smarter to buy and plant an apple tree, rather than buy a bag of apples for the same price as the tree. You don’t get the apples today, but in time, if you treat the tree right and then buy more trees, you get an endless supply of apples.”

TOP NEGOTIATION TIPS

1. If you don’t ask, you won’t get.

Negotiating for a better price is about being straightforward about what you want.

2. Be confident.

When you know the value of the property, stand firm and show the other party that you know what you’re doing.

3. Have a plan.

Be prepared with several counter-offers when you’re negotiating.

4. Know when too much is too much.

When the negotiations reach a limit that’s unreasonable for either party, it may be a good idea to walk away.

Send your details to