When it comes to commercial property, Scott O’Neill is an avid proponent. From a cash flow perspective, the returns can be significantly higher than those of residential, both in the long and short term. Part of his ethos is to educate investors about the benefits of putting their money into commercial, and reassure them about the risks involved.

“There is more due diligence required in comparison with residential properties, but when you get it right the returns are far larger”

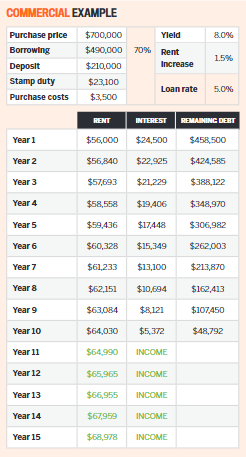

“Many investors are put off by lack of understanding, the larger deposits required – which typically run to about 30% – or by the fear of long-term vacancy,” says O’Neill.

But none of these challenges are necessarily insurmountable, and the ‘fear of vacancy’ usually comes from one or two horror stories from those who have never owned commercial property before, says O’Neill.

“The truth is that I can give you plenty more horror stories from residential properties,” he says.

“Investing in the wrong market at the wrong time can be a serious issue – just look at what happened to the value of properties in Perth or some of the other mining towns.”

By contrast, a well-selected, high-yielding commercial property has the ability to pay itself off within 10 years, O’Neill says. These benefits are possible because when you invest in commercial property you are less susceptible to market variations. As explained in last month’s column, the value of the property is typically based on the strength of the attached lease. Provided you carry out the relevant due diligence, commercial property can prove to be a stable source of passive income almost immediately.

“In addition to the property paying itself off, you will also get the benefit of capital growth and rental increases,” says O’Neill. “There are still risks, like with any investment, but they’re not necessarily in the places most people think they are.”

O’Neill is also positive about the interest rates associated with commercial property; typically they start from 3.5%, depending on the lender and whether it is fixed or variable, he notes. Though the required deposit tends to be higher, it does mean that paying off the loan is readily achievable with the right financial planning.

“If you take a look at the numbers for an example commercial property [see boxout], you’ll see what happens when you deposit the positive cash flow back into the debt,” says O’Neill. “You can see after 10 years you’ve now established a solid passive income of up to $65,000 a year. Not bad for a $700,000 purchase price!”

O’Neill stresses that, as with residential property, finding the right commercial property is the key.

“There is much more due diligence required in comparison with residential properties, but when you get it right the returns are far larger,” he says. “Working in consultation with the right advisor can help you make the selection that’s right for you, and also maximise your passive income stream into the future.”

Scott O’Neill is the founder and director of Rethink Investing, a BRW Fast 100 property investing company specialising in finding rare positively geared properties all around Australia (commercial and residential).

Scott O’Neill is the founder and director of Rethink Investing, a BRW Fast 100 property investing company specialising in finding rare positively geared properties all around Australia (commercial and residential).

Scott is an experienced and active investor who was able to retire from his day job at the age of 28. With a current portfolio of 32 properties worth $20m, he is one of the most successful young property investors in Australia. O’Neill has a passion for all aspects of property, especially helping others find great deals.

Rethink Investing helps everyday Australians enter the commercial property market with ease.

It also specialises in helping clients purchase high-yielding residential properties using the same successful investing strategy. Call 1300 965 551 or visit www.rethinkinvesting.com.au