In tough times, it can be hard to see a clear path forward – and the current environment can only be described as tough.

Plummeting property prices. The potential for negative equity. Everchanging government policies. A difficult credit market. Tightening home loan criteria. Struggles with refinancing, while coping with interest-only loans turning to principal and interest. A slowing economy and an opposition government hell-bent on confusing the issue further by tinkering with negative gearing.

It’s enough to make even the most seasoned, experienced property investor question the right way to respond. And these are just the external factors. Internal, more personal pressures, such as a relationship breakdown, holding an underperforming property, or grappling with dodgy tenants are other struggles that are impacting investors.

Some of us have been in the property game long enough to have survived many rough patches, such as the GFC (and the fallout in finance markets afterwards), or the mining boom and bust, along with myriad other ups and downs in real estate.

The ones who not only survive but thrive? They’re those who constantly look for new opportunities to learn, grow and pivot; who become more knowledgeable and sophisticated in their choices; who respond to challenges from a place of empowerment and clarity rather than fear and procrastination.

This is not always easy to achieve, however, especially if you’re struggling with real issues, like not being able to afford your mortgage, and hitting challenge after challenge when trying to refinance.

This is why we’ve put this expert guide together – to help you get past the negative sentiment and challenging conditions in an effort to make clear, concise and proactive decisions that help you move forward. Whatever you are struggling with, we hope you find value in the resources, tips and insights provided in this comprehensive expert guide to getting back on track!

Property problem #1:

BUYING A LEMON

A difficult property investing situation can hurt an investor’s pride just as much as their pocket – but bouncing back doesn’t have to be as complicated as you might think. If you’ve bought a property that isn’t performing anywhere near as well as you expected, there are steps you can take to right the course

Property investing is rarely a straightforward journey; there are setbacks to be endured and mistakes to be made along the way.

But when you do find yourself faced with a difficult scenario related to your investment property, it’s essential that you don’t bury your head in the sand and simply hope and pray that the situation sorts itself out.

Spoiler alert: it rarely does.

You need to take control of the situation in order to effect change, which is why Brisbanebased buyer’s agent Melinda Jennison from Streamline Property suggests that you sit down and attack the problem from every angle.

“Take an objective look at the situation and determine what the worst- and best-case scenarios are,” she says.

“It’s important to consider all options, and checking existing insurances is also a good idea, to see if any existing cover can protect your finances in the short term.

“Try to leave emotions out of it and focus on the numbers and the strategy, as when decisions are made on emotions you are often exposed to greater financial risk.”

Once you’ve looked at the problem from every angle yourself, it’s time to turn to the army of professionals at your disposal, who can help you strategise a way forward.

“In financially challenging situations, it’s a good idea to seek professional advice, as a different perspective can help guide you towards sensible decisions,” Jennison says.

“Property managers, for instance, can provide useful guidance if the hardship is due to non-payment of rent – and there are laws in place to protect a landlord in this situation. Or if mortgage repayments cannot be met, then it is definitely advisable to contact the lender and explain the situation. They may agree to accept smaller repayments in the short term, or even stall repayments for a while, although missed payments will be added to the overall debt.”

Dealing with property decisions that haven’t panned out as expected is a reality that many investors face, so there’s nothing to be ashamed about, Jennison adds.

“A client we worked with once found himself in a situation where he had negative equity in a regional property he had purchased,” she explains.

“After carefully considering his options, he made an informed decision to move forward by selling the property, but in doing so he had to take out a new mortgage on his own home for $250,000. It was a very high price for him to pay for a lesson, but when a bad investment performs poorly like this, it’s often better to cut your losses and get out, learn from your experience and move on.”

.JPG)

Before you face the practical steps of bouncing back after buying an underperforming property, you need to decide: how can you tell if you’ve bought a lemon in the first place?

“What exactly constitutes a lemon? Well, there could be a number of factors that affect a property’s ability to perform well from a cash flow and/or capital growth perspective,” says Miriam Sandkuhler, buyer’s agent and CEO of Property Mavens.

“If the property is costing you to hold it via negative gearing, and you have little or negative capital growth, then you may need to question the benefits of holding on to it.”

There are a number of investment fundamentals that can negatively affect your property’s ability to grow in value (see boxout). If your property has just one of these problems, you should carefully consider what you can do to fix or address the issue instead of selling, which should be your last resort.

However, if you are facing a number of these problems, then you need to ask yourself whether your money and borrowing capacity could be better invested elsewhere, rather than hoping that an underperforming property will get better.

“Reasons to consider selling include a lack of multiple growth drivers, such as employment opportunities, infrastructure and population growth. Ideally, you want these to ensure you have bought in the right location, as one growth driver in isolation isn’t enough to sustain long-term ongoing growth,” Sandkuhler says.

If you do consider divesting yourself of the property, she recommends that you seek the advice of your accountant regarding the implications of selling, especially if you will incur a capital gain or loss.

“You may also want to engage an investment specialist buyer’s agent who can do a portfolio review for you. They can provide evidence of key considerations, including supply and demand factors, population growth, employment opportunities and land availability, and do future financial modelling based on performance to date,” she says.

“As well as this, they can give you all of your options regarding selling or holding the property, with financial modelling to support the options presented, so you can decide how to proceed based on evidence and not merely guesswork, assumptions or hope. The stakes are too high!”

CASE STUDY : Victor Dong: ‘My $800,000 mistake’

Long-time property investor Victor Dong is no stranger to mistakes.

Long-time property investor Victor Dong is no stranger to mistakes.

During his journey to create wealth, he’s made a few costly missteps.

He shares how he walked away from a deal that would have made him $800,000 richer

“MISTAKES? I DON’T MAKE MISTAKES” is not something I have ever said. For I have made plenty of them!

From the time when I thought I was a share-trading genius (and lost $40k – the pain still stings) to the time when I was caught by the ruse of a cunning agent and slowly bid against myself (the sly fox got an extra $25,000 out of me), I’ve made more investing mistakes than I can keep count of.

But the greatest investing mistake from the school of hard knocks was the mistake of not taking action on the one that got away…

That was back in 2009. We were looking to buy in the North Parramatta region in Sydney. After months of open inspections and phone calls to agents, we happened upon a four-bedroom townhouse that was being sold by the mortgagee, with the auction to be held the following week. The poor owner had purchased it o the plan three years earlier for nearly $600,000.

On the morning of the auction, it felt like the heavens had really opened up – it was windy, it was wet, and it was positively freezing. So when we arrived we were met by the real estate agent, looking absolutely miserable, and one brave neighbour.

We were the only registered bidders. And thus the auction began…

“Any opening bids?” the agent said.

Silence was our reply. “The bank bids $310,000; this is the reserve,” he said, looking directly at us.

At this moment a bid of just $1 over the reserve would have secured the property. Still, we kept silent. We just shook our heads and left.

The price of not bidding? Well, in 2017, I saw that a similar townhouse in the complex had sold for $1.1m. I think we’ll leave it there.

There were many reasons why we did not bid. It was on the main road, the strata fees were high, and it was also during the depths of the GFC, when doom and gloom prevailed everywhere.

But most of all it was fear. Fear of the unknown, fear of making a mistake and fear of losing money. Here’s what I learnt from that pivotal experience:

• Leave your emotions behind

I’ve learnt to not be affected by negative market sentiment or fear of the unknown. Investing in any asset class is about numbers and strategy. If you are a believer that prices will rise in the long term, then leave short-term thinking at the door.

• Advice is key

Investing can feel like an individual sport, but the best investors are team players. If you don’t know something, ask. Build your team around you, which could include an accountant, mortgage broker, property manager, real estate agent, depreciation expert – the list goes on.

• Forgive yourself

Recognise that mistakes and failures are going to happen to you eventually; it’s what makes us human. Don’t dwell too much on what went wrong. Instead, forgive yourself and learn from the errors to ensure the fi rst time is the last time.

• Keep going

The most rewarding things in life are the hardest. Don’t sit around feeling sorry for yourself. Keep going! Success in investing is really just a numbers game. If you’re holding on to more winners than losers, you’ve come out ahead. Take it from me – I’ve been using these lessons to buy the next property and the next and the next!

They say the best time to plant a tree was 20 years ago, and the second best time is now. If you want to bounce back and make a fi nancial impact in your life, take that fi rst step. Pick up an investing book, go to a seminar (but keep your wallet at home!) or build that team around you – in 20 years’ time, you’ll thank yourself for it.

.JPG)

Property investment does come with risks, but there are many things investors can do to minimise their exposure to dud investments. It largely comes down to choosing strong assets and affordable properties

For all investors, whether you’re new to property or have been actively investing for many years, your very fi rst consideration should be budget when you’re purchasing a rental property.

“You want to make sure you do not fi nancially overcommit; this is an important fi rst step when building a property portfolio,” says Melinda Jennison from Streamline Property.

“You also want to ensure you have a fi nancial buffer in place in the form of liquid funds accessible through an offset account, for example, in case things go wrong.”

Furthermore, it’s essential that you don’t sacrifice quality to buy a ‘bargain’ property that sits within your budget.“Ideally, investors should purchase a property in an area where tenants can afford to pay the rent. The sociodemographics of an area can impact on rental returns and also property damage, which is why understanding the local area when you buy is important for mitigating this type of risk,” Jennison says.

Making sure you have adequate insurance is also essential.

“There are many types of insurances that need to be considered, the obvious one being landlord insurance, but also things like income protection insurance and life insurance need to be considered to ensure all potential risks are minimised,” she adds.

“Finally, selecting a good property manager who oversees the day-today management of your property is vital. Property managers are responsible for assisting with the process of selecting quality tenants, ensuring the tenants are looking after your investment property, and keeping tenants’ rent payments up to date.”

Property problem #2:

HOLDING ON TO DUD PROPERTIES

Almost all of us have experienced ‘sunk cost’ bias: it’s that attachment, logical or otherwise, to a purchase we’ve invested in that we can’t bear to let go of. The problem with sunk-cost bias is that it can keep you tethered to an asset that is sinking your financial future. Here Ben Kingsley Founding director of Empower Wealth and Chair of the not-for-profit Property Investors Council of Australia [PICA] talks us through sunk-cost bias...

Despite all our genius, humans are the only animals that suffer from sunk-cost bias. That’s right. Even laboratory rats know that their chance of survival increases when they look towards future rewards instead of backwards at their previous decisions!

Almost all of us have experienced sunk-cost bias at one time or another in our lives.

For example, have you ever bought an item of clothing and even though you’ve never worn it you can’t get rid of it, because you “might wear it one day”?

Or maybe you know someone who has stayed way too long in a relationship even though they know it’s run its course. And who can blame them – it’s really hard to say goodbye to someone you’ve invested so much time, effort and emotion into, isn’t it?

Or perhaps we’ve made a fi nancial investment that, despite our best intentions, just didn’t take off . While this really sucks, instead of trying to reverse the situation we bury our heads in the sand, choosing instead to rely on hope – hope that our fi nancial investment “just might come good”.

Does any of this sound familiar? If it does, then you know more about sunk-cost bias than you think!

Why pay attention to sunk costs?

Sunk costs are expenses – in the form of money, time, effort and/or energy – that you have already invested in a certain decision. These costs cannot be recovered, hence they’ve ‘sunk’.

Sunk-cost bias rears its ugly head when you focus on these past costs instead of looking forward at the potential future gains available to you, and at the positive outcomes, financial returns and overall beneficial impact that making a change could offer.

As you can imagine, sunk-cost bias can open up a can of worms. You can end up torturing yourself with ‘if only’ thoughts until you’re seriously mentally exhausted!

And the most devastating thing? We spend our precious time convincing ourselves that it’s better to live with a bad decision than to find a solution that could effectively move us towards solving our problem.

Of course, I get it. None of us likes the idea of loss. It doesn’t matter whether this is a real or perceived loss either. We’ll go to crazy lengths to avoid losing anything. We are emotionally attached to outcomes, and when we have to face the fact that a really big decision we made hasn’t panned out – well, that can be a difficult pill to swallow.

But you might not be aware that you are actually the one standing in your own way. You might be battling concepts like…

- Fear of immediate regret

What if I make a change and the turnaround doesn’t happen quickly? It’s easier not to change than to initiate change and hope for the best.

- Fear of wasting

This is where we try to justify to ourselves that it wasn’t a bad decision in the first place

- Commitment theory

We get stuck with a belief and choose not to change, even if the evidence that we should change is overwhelming.

- Cognitive dissonance

We exaggerate the benefits in order to make sense or justify the cost or the ‘loss’ that we’ve already incurred.

- Prospect theory and loss frames

We tell ourselves that change equals loss, more than it equals gain.

Here’s the point that I really want to hit home for you. All of the above might come into play, but the truth of the matter is this: smart people can, and do, make bad decisions. It’s a fact of life. No one is perfect all the time.

So the answer isn’t found in giving yourself a hard time. Instead, find it by creating a clear picture of why you made the decision in the first place. This requires asking yourself some high-quality questions so you can see things clearly. Questions like…

- Was I thinking logically or emotionally when I made my first decision?

- Did I do an adequate amount of research before taking action?

- Given what I know now, would I make that same purchase again?

- In my current situation, am I sacrificing other opportunities because of my sunk-cost bias?

- Are these missed opportunities detrimental to the overall outcome I’m trying to achieve?

- Would I tell my loved ones to make the same decision as I have?

- Ten years from now, will I be happy with the choice I’m making today?

At the end of the day, all of us have made decisions that don’t work out. That’s life. But that shouldn’t be where the story ends. Far from it. The trick is to arm yourself with information – cold, hard facts and data – to help you make an informed decision.

Our brains are wired primarily for survival. So now that you know about sunk-cost bias there is no further excuse not to do what you need to do. You understand the concept now, and you can drown it out with tangible logic and researchbacked evidence to make that all-important next step.

Which means: you’ll know when it’s really time to quit, and you’ll be able to take action with confidence. After all, knowledge is empowering – but only when you act on it.

CASE STUDY: Nick and Alana Hayes

1-bedroom NRAS-subsidised unit, Fortitude Valley, Brisbane

.JPG)

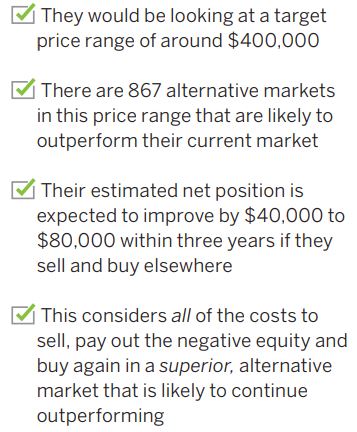

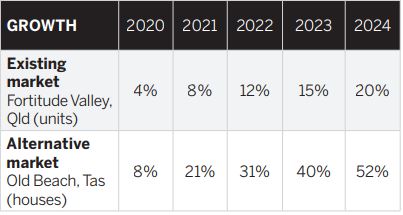

When Alana’s father passed away in 2012, she was gifted $120,000, which she invested in an off-the-plan, one-bedroom NRAS-subsidised apartment in Fortitude Valley. But what should have been a silver lining has since slid in value by about $50,000 from its original purchase price of $400,000, leaving the Queensland couple drained and wanting to avoid making a decision altogether.

“We definitely got duped on this one by the slick sales pitch. After that, I guess we just got busy working and having kids, and stuck our heads in the sand.”

Crunching the numbers Nick and Alana purchased the off- the-plan apartment with a 100% loan-to-value ratio, using equity from another investment property and leaving the gift from Alana’s late father in an offset account to offset the loan. This, plus the drop in value, means the property is now in a position of negative equity.

The good news is they’ve pumped an amazing $284,000 into the offset account in six years. So, even with the capital losses, the property is about $5,000 a year cash flow positive. This, as it turns out, will be the saving grace in their situation. See the following scenarios.

SCENARIO 1 – SELL AND BUY ELSEWHERE, RESERVING $100K

Using Empower Wealth’s Sell or Hold calculations, it’s clear that it will cost them $13,500 in agent’s commission and legal fees to sell. No growth means no capital gains tax; if they keep $100,000 in reserve, they still have more than $100,000 to ‘go shopping’ with:

SCENARIO 2 – HOLD AND TAKE NO FURTHER ACTION

If Nick and Alana do nothing:

- Their net position is expected to improve by about $60,000 in three years through a combination of single-digit capital growth and positive cash flow.

- However, the opportunity cost for the top suggested alternative markets is in excess of $100,000!

- The opportunity cost will far outweigh the cost of entering and re-entering the market.

For example, if they reinvested their funds in the suburb of Old Beach, Tasmania, this is what the investment timeline could look like when compared to their current property:

Wondering if you should Sell or Hold your investment property?

Create a free user account at Sell Or Hold and find out!

Property problem #3:

FINANCE ISSUES

Whether you’ve found yourself in financial strife due to poor decisions, financial mismanagement, or a property portfolio that is going backwards in value, there are solutions to help you get back in front of the issue

There have been plenty of changes to lending requirements over the last few years. For investors, this means you can no longer assume that you can do what you did last time you applied for finance and expect an approval.

Mortgage consultant Graeme Salt, managing partner at Chan & Naylor Finance, says tighter servicing remains an issue for many of those who are looking to buy property or refinance, adding that there are now “thousands of borrowers with loans that would not be approved today, given how lenders are putting the squeeze on credit”.

“Nowadays, there’s a lot more legwork in a finance application,” Salt says.

“Comprehensive credit reporting means that, a long way before making a finance application, borrowers need to be sure they have a good record in paying things like credit cards and utility bills. Plus, when banks assess loan applications, they now want to see up to three months’ transaction statements, which means that if your bank statements show loads of references to Afterpay or Deliveroo, they may question your commitment to paying off a loan.”

Putting your best possible foot forward is essential in this fractured finance marketplace. But what strategies can you use if you’re in a financial pickle and you’re not sure how to move on?

Dealing with negative equity

Negative equity is what happens when the loan you have on a property is worth more than the value of the property itself. For instance, you might have a loan of $600,000 secured against a property that is worth $530,000.

This is obviously a distressing situation to be in; no one likes the idea of holding excessive debt against an asset that is meant to be building their wealth, not stripping it.

“We are seeing a number of valuations come in down at the moment. This is having a significant impact on the loanto-value ratios, which are an important criterion for lenders in their assessment of a loan,” Salt says.

“Thankfully, prices have not dropped so much that we are seeing lots of examples of negative equity where a house is now worth less than the mortgage.”

But here’s the thing to keep in mind if you find yourself in the situation of having negative equity: unless you are a position of being forced to sell the property, it is only negative equity on paper, and you may be able to rebound from it.

The first step is to work out exactly how much you owe on the asset on a week-to-week basis, to ensure it’s affordable. If you find that the gap is too large between the income the property produces and the expenses you have to pay to upkeep it, then it might be a good option to refinance.

“As interest-only restrictions lift, there are some great pricing opportunities to explore. Over the last 12 to 24 months, all lenders have increased interest rates, but they are reviewing them now – those borrowers who can meet their criteria can benefit by up to, and even beyond, a 1% saving,” explains mortgage broker Andrew Mirams from Intuitive Finance.

A 1% interest saving on a $500,000 mortgage is $5,000 per year, or almost $100 per week, which could make a huge difference to your overall cash flow.

The key here, of course, is the property’s offcial valuation. If there is evidence that the local property values in the area have gone backwards, and you don’t have enough equity in the property, then refi nancing may prove diffcult – or extremely expensive.

This is where an experienced fi nance broker can be your best ally, as they can help you navigate the way forward in the most productive way possible. Taking into consideration not just this property but all properties in your portfolio, along with your lifestyle, income and other expenses, a good broker can help you formulate a plan that allows you to ride out your negative-equity situation in the short term.

“It can be difficult [to refi nance], but doing it with the right research, guidance and knowing the desired outcome is most important. Lenders are still open for business!” Mirams says.

“I believe that more and more investors will continue to seek out professional mortgage brokers to assist them with the complexity of the current market forces, to achieve the right results. I’m not saying people can’t do it themselves, but it’s almost impossible for people to know the best rates in conjunction with the best policies to ensure they achieve their desired outcome.”

Property problem #4:

RELATIONSHIP BREAKDOWNS

Divorce is one of the major reasons why property owners are forced to sell, and the consequences can be costly. How can you navigate this emotional time without falling apart – mentally or financially?

Fiona Isherwood is a senior buyer’s agent at Core Advisory, and in her line of work she meets a lot of people who are searching for a new home to live in due to separation or divorce.

Unfortunately, she understands the pain and upheaval of relationship breakdowns on a personal level, having separated from her husband a couple of years ago.

“When you’re right in the thick of it, you’re not necessarily in the right headspace to be making these big financial decisions to do with selling the family home, or buying a new home. But these decisions still have to be made,” Isherwood says.

“Separating properties is a big undertaking, and having an unbiased advisor to help you through that process can be invaluable.”

This is why Isherwood has begun specialising in working with newly separated couples.

“I was quite lucky in my situation, in that a friend referred me to a separation strategist, and I’ve since learnt about divorce coaches as well. If you’re in that early place after separating, I highly recommend you get one of these people on board. You might see a therapist or a counsellor as well, but someone who specialises in separating can be really useful,” she says.

“It’s awful to see people going though these terrible breakdowns, where it’s dragged out and racks up $500,000 in legal costs – which actually happened to a friend of mine.”

Legal help may be potentially pricey, but it’s essential to get a solicitor on board, Isherwood adds.

“Every second person I speak to, they’re either going through it, have gone through it, or know someone close who has been through it. It’s not always amicable, so it’s important to have people on your side to guide you through,” she says.

“Working with a good mortgage broker, an accountant, a fi nancial planner and a buyer’s agent is going to help you build yourself back up again. There are so many steps and so many people involved – and it’s really reassuring to know you’ve got the right advisor with you at each step of the process.”

You’ve separated: what next?

First things first: you need to do an overview, and pronto.

“Who took care of the money? Who was responsible for fi nances and paying the bills – you, or your spouse? If it’s a discussion you can amicably have, then it would be wise to sit down and work out who was responsible for money and what the action plan is from here,” advises mortgage broker Nancy Youssef, founder of Classic Finance.

“If it’s nasty and this isn’t possible, and you have joint accounts, then you might want to close them and seek legal advice immediately.”

Next, it’s time to do a full fi nancial stocktake of what your assets, debts and liabilities are, and to ensure that any money you owe together or individually is accounted for.

“Does the ledger balance? Has there been any spending that shouldn’t have taken place? A lot of break-ups happen due to money issues, so this can be quite contentious,” Youssef says.

“If you have rental properties, this would be a good time to talk to the managing agents to let them know of the split, so they know what’s going on and are aware you both need to be across decisions.”

It’s also a good idea to keep the bank abreast of the situation if you have a mortgage, she says. This may seem like a difficult conversation to have, but Youssef says it’s crucial that you have the discussion before your fi nance situation potentially worsens.

“It’s better to keep the bank in the loop, rather than to hide it, because once you fall behind in your repayments, recovery action will start taking place – and that’s the last thing you need. It just adds to the stress,” she says.

“Instead, call the bank. Explain what is going on. They get these phone calls every day, and they can be very understanding, as unfortunately divorce happens all the time.”

The lender may even be able to offer you a repayment holiday while you’re getting back on your feet.

Separating and selling

Accredited property investment advisor Miriam Sandkuhler, CEO of Property Mavens, agrees that turning to professionals for help is essential at this very difficult time.

“When dealing with property during a separation or divorce, couples face many challenges while journeying from selling the family home and/or investment properties to buying into the market again and creating future financial security,” Sandkuhler says.

“Couples must be wary of advice from well-intended family and friends, and seek expert and professional guidance to minimise mistakes instead.”

The actual process of physically separating your living arrangements and selling the family home is understandably “a highly emotional time”, Sandkuhler says, which is why it’s important that any decisions made during this time are as unemotional as possible.

According to Sandkuhler, the challenges that couples face include (but are not limited to):

- divesting of property, which can be very complex

- arguments, rash decisions being made, or inertia setting in

- making emotional decisions/mistakes

- mistrust in relationships, which can stop people from moving on with their lives

“This is where an independent vendor’s advocate can help. They can help you to determine the best sale method, when to sell in terms of market timing, and the property’s appraised value,” she says.

“Once the property has sold and your budget is known, you need to assess your next steps.”

Buying for the next stage of life

Just as important as moving on from your previous home is considering your needs and next steps. Careful planning must be undertaken before you rush out and buy another property.

“This is where I have seen clients make mistakes and buy the wrong property type in the wrong location, because of short-term thinking and not enough long-term planning,” Sandkuhler says.

“It’s OK to rent for 12 months to let the dust settle if you don’t feel ready to buy straight away.”

The caveat to this is that if you are in a rising market it is important to get back into the property market as soon as practical, which is why expert advice is paramount.

“This is often where I see women freeze, as they lack confidence and knowledge and don’t know where to start or who to trust – but leaving money sitting in the bank doing nothing can be a fatal error. Hoping for Mr Right to come along so you can buy again with someone else may also be detrimental to creating financial security for yourself,” she adds.

“Men on the other hand often race out and buy again, but it may not be a well-considered purchase. They might buy a low-maintenance apartment or villa, but if there are only two bedrooms, what happens when the children are older and don’t want to share a room?”

Sandkuhler urges those who have newly separated to consider the following before they buy:

- Do you need to factor in kids living with you, and for how many years?

- Can you buy in the area where you are currently living or where they go to school?

- Do you have enough money to buy where you want to live, or are you better off rentvesting?

- What do you need in terms of lifestyle and amenities (after the kids leave home)?

“This is where an independent, licensed buyer’s agent can help. They can help you to determine a buying strategy and research, source, assess and negotiate on your behalf to make sure you buy well, make good decisions, minimise risk and don’t overpay.”

.JPG)

.JPG)

.JPG)