Owning a property portfolio worth more than a million dollars is not only possible but can be done relatively easily and quickly with the right strategy, as Todd Polke explains

Ever said this to yourself: “I want to be a millionaire”? Millionaire status is the milestone that every wealth creator wants to reach. Currently in Australia, there are only 192,000 millionaires. This is only 0.8% of the population.

We want you to join the millionaire ranks!

This is a step-by-step guide to how to construct a property portfolio and build a $1m portfolio, debt-free, using real numbers, real market conditions and real strategies. Various team members were employed to ensure the accuracy of all figures used in this article, including mortgage brokers, accountants, and acquisitions team members. I will use a current client situation to illustrate these steps, which I will describe to you over the following pages.

There are some key philosophies that I apply in almost all portfolio construction strategies, which are important to understand before we move forward.

1. Property investing is a business and needs to be treated that way. This means that it needs to be separate from your personal life and should not absorb all your cash flow. Your portfolio is supposed to enhance your life, not take away from it.

2. Get caught up in the outcome, not in the property itself. Focus on the fundamentals of the deal itself and make strategic investment decisions based on facts, not on personal emotional decisions.

3. There are stages in your portfolio to focus on.

When investing, the three main stages are:

- Acquisitions: The main priority is creating leverage in the market and expanding your portfolio.

- Consolidation: This is when you begin consolidating your portfolio and your debt.

- Lifestyle: This is when you create strategic results in your portfolio based on your outcomes.

If you focus on debt reduction and expansion at the same time, it will dilute your results. Focus on one stage at a time.

4. It is not about the number of properties you have. Don’t get caught up in the number of properties you own; instead focus on how they are helping you achieve results.

5. Buy every property and make every finance decision with the next three moves in mind. Always ask the question: “How is this property going to get me closer towards my million-dollar portfolio?”

How to make the most out of this article

When reading this article, focus on the strategy itself and not on the individual deals. If the strategy is equity-based, then buy a property that will produce equity. You can create equity in many ways, from finding discount deals to building and renovations, strata titling and so on. You don’t have to purchase a deal with the specific criteria I have used.

To show you how this can be done in real life, let’s use our investing pair as a case study. Peter and Mandy are couple with one child and an average household income.

Based on our discussions and analysis, Peter and Mandy consider themselves to be quite conservative; however, they are happy to take measured risks with education and support.

There are a few assumptions I have made when mapping out a portfolio over a 10-year period. They are:

- Wages: Wages increase at 3% per annum.

- Rent: Rental income increases at 3% per annum.

- Capital growth rates: I have adapted property growth rates depending on the deal itself. However, the average capital growth rate used is only 5.9% per annum across the portfolio. Interest rates: We start at 2013 interest rates and increase to 7% over time, which is in line with many economists’ projections of the interest rate environment.

- Serviceability: This has been calculated after each year to ensure the banks will still continue to lend us money for the next deals. Using current servicing calculators all of the following purchases work.

- Savings: As net income goes up, savings will also increase. However, only 50% of the wage increase will go into savings; the rest will go into improving Peter and Mandy’s lifestyle.

Putting theory into action: How to build a million-dollar portfolio debt-free as fast as you can

Now that we have met Peter and Mandy, we can analyse their situation. There are a few things we need to consider:

- The interest rate on their owner-occupier loan is high compared to the current market, at 5.45%, and can be reduced to the current market rate.

- Our buying power and serviceability is a relatively balanced figure, meaning we can move forward with a balanced strategy in regard to equity and cash flow.

- Both individuals have minimal tax deductions as PAYG employees, and are presently paying the full marginal tax rate.

- The current debt level is relatively low, with only a car loan. Their credit card is paid in full each month, and they have a regular savings plan. This suggests Peter and Mandy can manage their money relatively well.

Year 1 strategy

FINANCE

- Refinance their home mortgage to reduce the interest rate to 4.84%, and fix 70% of the loan for three years to lock in the low rate and secure against any upward swing in rates.

- Leave 30% as a variable loan to keep in an offset account to offset the personal mortgage on Peter and Mandy’s home with their savings, buffer and ongoing income.

- All of their personal income will be directed into the offset account and they will live off a credit card for most of their personal expenses, which will be paid off each month. This will maintain the maximum balance in their offset account, and compound to reduce overall interest paid.

- Switch the loan to interest only and use the offset account to reduce the interest payable. A focus on debt reduction will come later in the portfolio.

TAX

Peter and Mandy have minimal deductions to legally reduce their tax, but with more investment properties they will have more deductions. Tax refunds will be filtered back into the portfolio for further deposits and buffers.

DEBT MANAGEMENT

At this stage of the portfolio, we aren’t focusing on debt reduction as the primary outcome. However, this will happen organically through the use of the offset account.

PROPERTY SELECTION

We will look to do two purchases within the first six months, which can be achieved comfortably with serviceability of $1.1m and buying power of $960,000.

PROPERTY 1

STRATEGY: Blue chip, buy and hold

PURPOSE: This will become the cornerstone of our million-dollar net investment portfolio and will provide solid capital growth over the coming three to four years.

LOCATION: I like to secure our better-quality properties at the bottom of the market or close to it. This gives us the opportunity to leverage against the upswing in the property market. As the market cycles shift, we can accumulate our better-quality properties in different states to create diversity in our portfolio.

The key market to focus on right now is Brisbane, which is offering some of the greatest value for true blue-chip properties. I would prefer this to be within a 5km radius of the Brisbane CBD.

PRICE POINT: We need to be strategic about this, as it will impact on many future deals due to our current level of buying power and future capacity for equity creation, savings and tax refunds. We will target a price point of $350,000-$450,000 maximum.

YIELD: For blue-chip properties close to CBD locations, a 5% yield is relatively typical. This is what our servicing figures are based on, so I won't drop below this figure as it would affect future deals.

PROPERTY 1 DETAILS:

- Property type and strategy: New one-bedroom unit in a blue-chip area

- Location: Newstead, 3km from Brisbane CBD

- Purchase price: $400,000

- Rent: $430 per week, giving us a 5.6% gross rental yield

- Ownership: 90% ownership will be in Peter's name, as is paying the most tax and this property will reduce tax owed for the next financial year

- Finance: We are financing at 90% LVR with a separate bank to that used for the principal place of residence (PPOR) to avoid cross-collateralisation – ensuring we set a strong foundation for the portfolio

Loan (90% LVR): $360,000

Deposit: $40,000

Purchasing costs: $20,000 (5% of purchase price is rule of thumb)

Total cash outlay: $60,000

Cash flow

Rent: $430

Gross yield: 5.6%

After-tax cash flow: -$11 per week

Before-tax cash flow: -$73 per week

Tax refund: $3,238

Remaining capital

Initial capital: $145,000

Equity used: $60,000

Remaining equity: $85,000

Remaining buyer power: $566,000

PROPERTY 2

STRATEGY: Accessing equity from own home.

PURPOSE: The purpose of this strategy is to create a chunk of equity to recycle for future deposits and costs, potentially within a 12- to 18-month period. In this market, house and land deals are currently working well. Essentially, the strategy is designed to increase our buying power. We may or may not hold property for the longer term, depending on how the portfolio evolves.

LOCATION: We want to target a strong growth area to maximise the potential for equity creation. This means major metro areas or strong, diversified regional locatioons such as Newcastle, Toowoomba and Southwest Sydney are key target areas. They have similar characteristics and we would potentially be happy to hold property for the longer term if it still served a purpose in the portfolio.

PRICE POINT: $400,000–$500,000

YIELD: As with our blue-chip strategy, house and land deals in these locations generally only offer approximately 5% rental yield. We are using this as our minimum benchmark.

PROPERTY 2 DETAILS:

- Property type and strategy: Four-bedroom house and land construction

- Location: Newcastle, NSW

- Purchase price: $450,000

- Rent: $480 per week, giving us a 5.5% gross rental yield

- Ownership: 90% ownership in Peter’s name, as he pays the most tax and this will reduce tax owed for next financial year

- Finance: 90% LVR with a separate bank to the PPOR and the Brisbane blue-chip deal, to avoid cross-collateralisation

Purchase price: $450,000

Loan (90% LVR): $405,000

Deposit: $45,000

Purchasing costs: $22,500 (5% of purchase price is rule of thumb)

Total cash outlay: $67,500

Remaining capital

Initial capital: $85,000

Equity used: $67,500

Remaining equity: $17,500

Remaining buyer power: $116,666

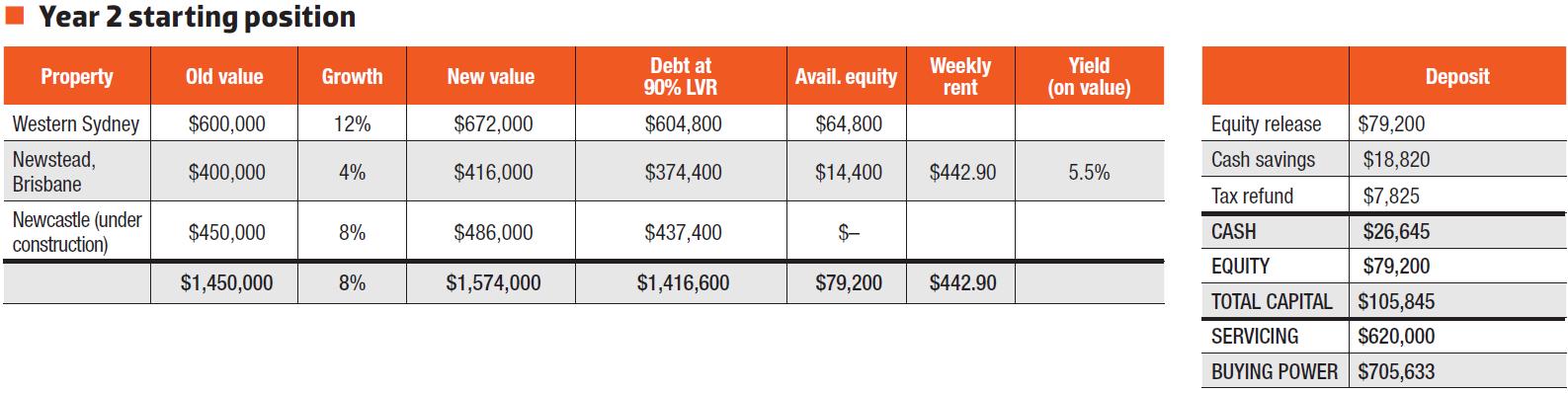

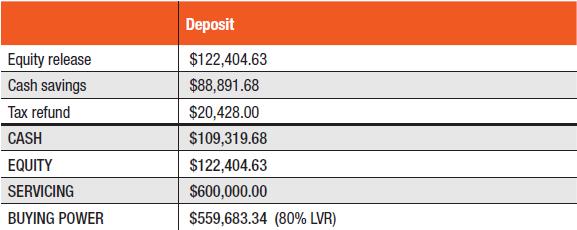

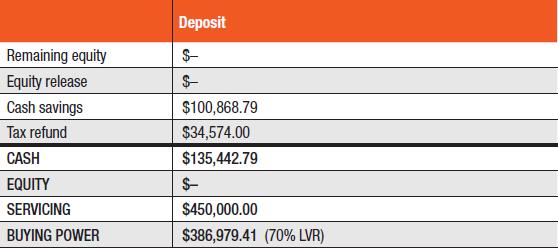

Year 2 Starting Position (Click image to enlarge)

Year 2 outlook

- After two purchases in Western Sydney and Brisbane in 2013, our first year, and with construction started in Newcastle, we receive some solid growth in both Newcastle and Western Sydney and very moderate growth in Brisbane.

- We are able to release additional equity from their home and a small amount from Brisbane after a 12-month period, in addition to some savings and a tax refund. It sets us up to move forward with potentially two more purchases over the next 12 months.

- The first of these purchases is made at the start of the year and we intend to make a second purchase in the second half when we have accumulated more savings, once Newcastle is completed and we can release equity, and once we have also got our tax refund.

- Our servicing is decent, with $620,000 still remaining so we can move forward with our next deal; however, if we do the wrong deal at this point, it could jeopardise our future serviceability.

- This is a point at which a lot of people get stuck. Continuing to chase equity deals only and hitting a serviceability wall needs to be avoided through strategy.

- We are also now going to set up a PAYG tax variation to begin receiving our tax back on a monthly basis and applying it to our offset account rather than receiving it in one lump sum at the end of the year. This will further increase the debt reduction strategy on the personal mortgage of the PPOR.

PROPERTY 3

STRATEGY: Cash flow and growth

PURPOSE: Servicing is starting to tighten and we need to focus on lifting this moving forward, with a strong-yielding property.

LOCATION: In the 2013 market when these deals are being done, rental yields have begun to tighten as the market is growing, so high-yielding properties have to be manufactured either through a dual-income strategy, furnishing, or going out into deep mining, which I am not comfortable with in this economy. Although the primary purpose is yield, we still want to target a moderate growth area.

PRICE POINT: $450,000 maximum

YIELD: Yield is key for this property, so we target a gross yield of 7% or higher. Understand that a 7% yield is not going to dramatically increase servicing; it is only going to support it at this point. This property is being strategically placed to support servicing and lift it into the future.

PROPERTY 3 DETAILS:

- Property type and strategy: Dual-income strategy. Construct a three-bedroom house with a three-bedroom house with a three-bedroom adjoining flat to rent out separately and one title

- Location: Peregian, Sunshine Coast, Queensland

- Purchase price: $430,000

- Rent: $600 per week, for a 7.2% gross rental yield

- Ownership: 90% ownership will be in Peter’s name as he is paying the majority of tax and this will help reduce his tax for the next financial year

- Finance: We will do this deal at a 90% LVR and with a separate bank to all other properties

Purchase price: $430,000

Loan (90% LVR): $387,000

Deposit: $43,000

Purchasing costs: $21,500 (5% of purchase price is rule of thumb)

Total cash outlay: $64,500

Remaining capital

Initial capital: $100,200

Equity used: $64,500

Remaining equity: $35,700

Transfer to buffer: $5,000 (this will top up our property buffer by $5,000)

Net equity position: $30,700

Remaining buying power: $204,666

FINANCIAL SITUATION BY THE SECOND HALF OF YEAR 2

- Peter and Mandy have $30,700 left over

- They can save another $7,500

- They can do a loan increase on the Newcastle house and land once construction is completed. The market has grown by a solid 8%, creating an additional $32,400 that we can release

- Total new cash/equity = $70,600

- This gives a new buying power of $470,666 at 90% LVR

We are now ready for another purchase in the current year.

PROPERTY 4

STRATEGY: Equity/growth

PURPOSE: Equity-based property that may or may not be held for the longer term, depending on the market.

LOCATION: The Sydney market is quite hot now; however, the Southwest region is still offering some value, especially due to more affordability compared to surrounding areas, continued population growth and strong infrastructure expenditure. We target areas like Liverpool and Campbelltown.

PRICE POINT: $350,000–$450,000

YIELD: 5% as standard; however, the higher the yield, the better it will support servicing.

PROPERTY 4 DETAILS:

- Property type and strategy: One-year-old two-bedroom unit 400m from Westfield Shopping Centre and the train station.

- Location: Liverpool, NSW

- Purchase price: $390,000

- Rent: $430 per week, giving us a 5.7% gross rental yield

- Ownership: Peter's tax has been reduced after our first three deals, so we now flip the ownership into a 50/50 arrangement.

- Finance: We will do this deal at 90% LVR, with a separate bank to those used for all other properties

Purchase price: $390,000

Loan (90% LVR): $351,000

Deposit: $39,000

Purchasing costs: $19,500 (5% of purchase price is rule of thumb)

Total cash outlay: $58,500

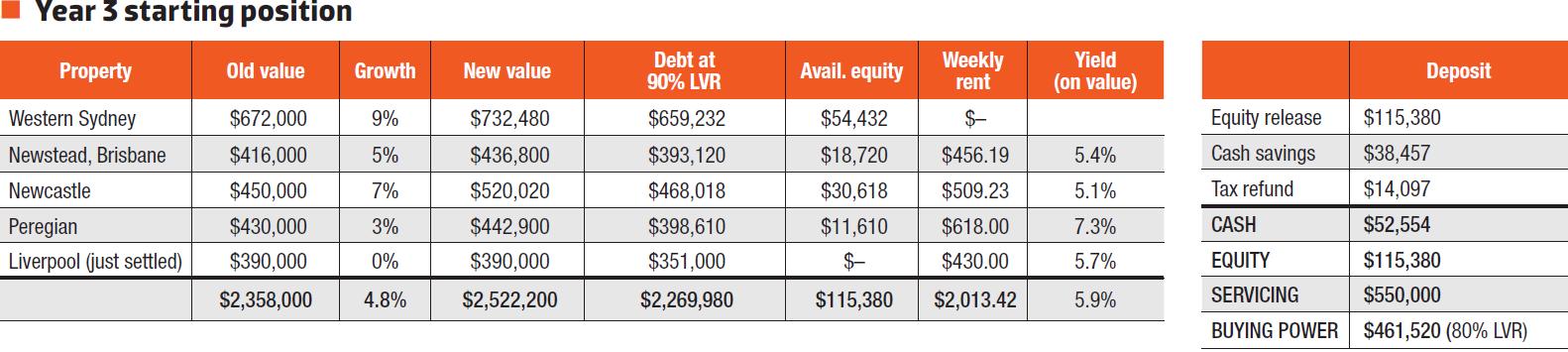

Year 3 Starting Position (Click image to enlarge)

Year 3 outlook

- Year 2 saw us complete an additional two property purchases and the construction of the Newcastle house and land, which we pulled some equity out of.

- Our focus in the foundation years of this portfolio is about ensuring our servicing stays solid and we can continue building equity in our portfolio to move forward.

- We are now set up in four separate locations across two states, giving us solid portfolio diversification, with a combination of properties that we will keep and some that can become trading fodder in the future.

- Due to the high rental yield of the dual-income strategy on the Sunshine Coast in Queensland, and by gaining some moderate income increases as per assumptions at the beginning, our serviceability has only dropped by $40,000 from the beginning of Year 2 to $550,000, and we still have buying power of up to $585,000 without releasing any equity from Liverpool, which we may be able to look at doing mid-year if required.

- We are still in a relatively balanced position in terms of servicing ($550,000) and buying power ($585,000), so we need to continue focusing on both servicing and equity creation in Year 3.

- The key difference at this stage of the portfolio is that we will be dropping our future purchases down to 80% LVR.

- The reason for this is to ensure that our servicing stays strong in the future, and to begin to deleverage Peter and Mandy, which suits their personal life outcomes.

- This is also a strategic lending decision based on our intention for the next deal moving forward in Year 3. We will only complete one property transaction this year.

PROPERTY 5

STRATEGY: Equity/growth

PURPOSE: Equity is the name of the game in this next deal, with the outcome being to stack this up in the trading bucket for the future. As it has proved an effective strategy, we aim to continue down the construction path in Year 3, to see how we can create equity on the way into the deal. We have already begun to handle the servicing issue by focusing on doing this deal at 80% LVR.

LOCATION: Our choice of location is based on a combination of factors: one is obviously to continue to target a solid growth market, which we can still see shuffling forward for a few years yet, and the second is a price point decision.

PRICE POINT: $585,000 is our maximum price point, due to buying power constraints. We are happy to stretch to close to this point as we still have a solid buffer in place for Peter and Mandy’s personal life and property portfolio.

YIELD: 5% as standard; however, the higher the yield, the better it will support servicing.

PROPERTY 5 DETAILS:

- Property type and strategy: Duplex build strategy

- Location: Toowoomba

- Purchase price: $545,000

- Rent: $660 per week, giving us a 6.1% gross rental yield

- Ownership: Peter’s tax has been reduced after our first three deals, and we now flip the ownership into a 50/50 arrangement

- Finance: As mentioned, this deal was always going to be done at 80% LVR for two reasons,the first being serviceability, and the second relates to financing. At this point I have already been working with other mentoring clients on doing duplex builds in Toowoomba and through our mortgage broking team, and we have been able to find some loan products offering to do 80% lends on end valuation after the build. This meant we realised some of our profit almost instantly and did not have to outlay the full 25% deposit into the deal.

Purchase price: $545,000

Loan (80% LVR): $480,000

Deposit: $44,000

Purchasing costs: $27,250 (5% of purchase price is rule of thumb)

Total cash outlay: $71,250

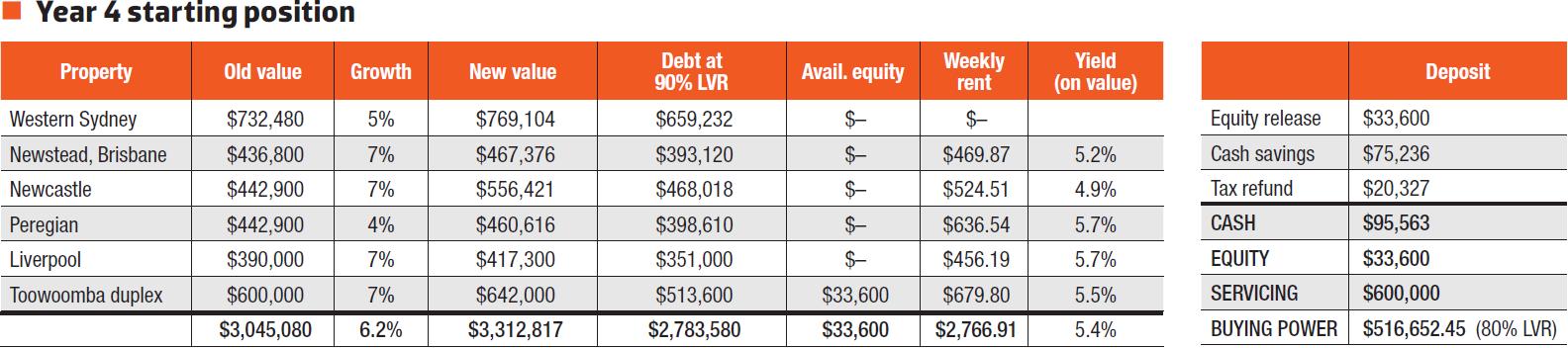

Year 4 Starting Position (Click image to enlarge)

Year 4 outlook

- We are seeing a major shift in the portfolio at this point, in that we have hit a serviceability wall in our borrowing and are now focusing on 80% lends for all future deals.

- This is a common hurdle that most investors come up against in their journey. It has good and bad points: good, in that we are now deleveraging our debt position and beginning to shift the portfolio to a more positive nature; but the downside is that we need much larger deposits in order to continue investing and allow our current portfolio to fall below the 80% LVR level so that we can access additional equity.

- What we can see from the above summary for the start of Year 4 is that, with $129,000 in capital for deposits and costs, we have a buying power of $516,000 at 80% LVR. Our servicing is still solid at $600,000, and this is being maintained due to growing yields and income, as well as by lowering the debt level we are leveraging with compared to value.

PROPERTY 6

STRATEGY: Blue chip – buy and hold – off the plan

PURPOSE: This next property will add another cornerstone to our ultimate portfolio and set us up again in a long-term growth market, with a short-term upside as well.

LOCATION: For our blue-chip property purchases, as mentioned earlier, I want to see that we are buying at a value stage of the property cycle in major metro areas. Currently, we have a good-quality property in Sydney as a home, and we have secured a core holding in Brisbane.

PRICE POINT: We can go up to approximately $700,000 for this blue-chip deal, with $70,000 available as a 10% deposit. However, sub-$600,000 is our target point.

YIELD: 5% is our benchmark

PROPERTY 6 DETAILS:

- Property type and strategy: Off-the-plan blue-chip townhouse. We will target a townhouse rather than a unit for this purchase, as there is still a concern about the potential oversupply of units in the Melbourne market

- Location: Melbourne

- Purchase price: $580,000

- Rent: $660 per week, giving us a 6.1% gross rental yield

- Ownership: Peter's tax has been reduced after our first three deals, and we will now flip into a 50/50 arrangement

- Finance: As mentioned, this deal was always going to be done at 80% LVR for two reasons: the first being serviceability, and the second financing

Purchase price: $580,000

Loan (80% LVR): $464,000

Deposit: $58,000 (10% deposit for off the plan)

Purchasing costs: $27,250 (5% of purchase price is rule of thumb)

Total cash outlay: $71,250

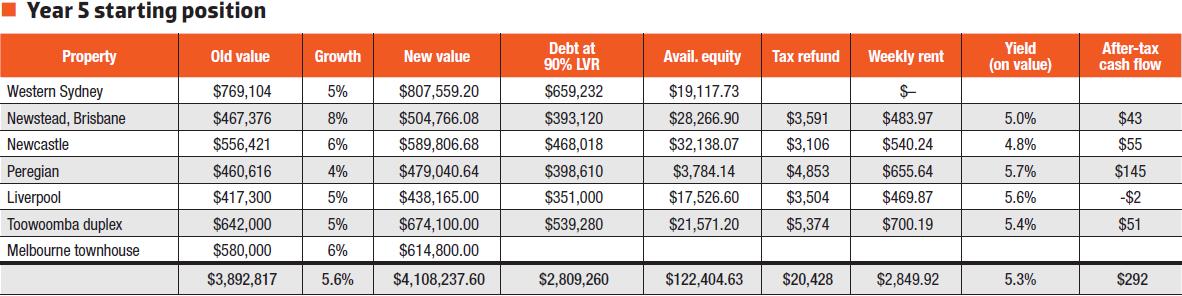

Year 5 Starting Position (Click images to enlarge)

Year 5 outlook

- At some point in our investment journey, we just have to sit and wait and let the market do its thing for a year or so.

- There is potential for us to bring one of the other properties up to 90% LVR to move forward again in the following year. However, we are well on track to achieving the results Peter and Mandy are after within the timeframe they require.

- Our focus in the next 12 months is just to settle the Melbourne property and allow the other properties to move a bit more during this year.

- This year, we will just sit steady.

- This is also the halfway point in our 10-year strategy, and there are some additional milestones I want to bring up here, which have been dramatic steps in Peter and Mandy’s overall wealth creation.

DEBT ON PPOR

Through the effective use of an offset account, Peter and Mandy have been able to pay off their original personal mortgage of $395,000 on their own home completely, simply by getting their money working harder for them. (Mortgage reduction software was used to calculate this, and is accurate.)

TAX

Personal tax has been reduced by over $20,000 and is now being received in the fortnightly pay cheques Peter and Mandy receive through a PAYG tax variation.

CASH FLOW

The overall portfolio is cash flow positive to the tune of $292 per week.

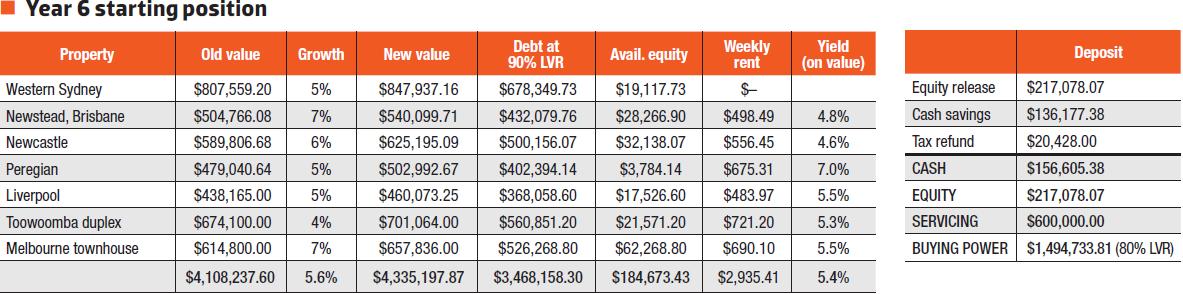

Year 6 Starting Position (Click image to enlarge)

Year 6 outlook

- Our third buy-and-hold blue-chip property was settled in Year 5 in our third state of Australia, while the rest of the portfolio continued to move gently in the market.

- Peter and Mandy’s portfolio has reached a critical mass and the equity is starting to take on a life of its own.

- We now have seven properties in the portfolio, all below 80% LVR and cash flow positive after tax.

- Our buying power sits at $890,000, while servicing has become our limiting factor, still sitting at $500,000. We have reached a critical milestone: the new value of our investment properties has reached $4.47m, with a debt level of only $3.35m.

- We have reached $1.11m in net equity, the fundamental goal we were aiming for: $1m in net investment assets.

- We are not quite ready to consolidate the portfolio yet, as to sell down would result in selling costs and capital gains, so we need a bit more time. However, we are well on track and will look to move into the consolidation phase within the next 12 months, while we drip-feed further properties into the portfolio.

PROPERTY 7

STRATEGY: Equity builder

PURPOSE: We have core properties that we are going to hold for the long term in Brisbane, Western Sydney, Melbourne and perhaps Newcastle. Now the focus is on eliminating debt. This new property is designed to create equity, but ultimately to trade to pay down debt in bigger chunks.

LOCATION: Growth market with add-value opportunities

PRICE POINT: $650,000–$750,000

YIELD: 5% is our benchmark

PROPERTY 7 DETAILS:

- Property type and strategy: Duplex build strategy. Through the build process we expect to increase our equity on the build price by 10%, meaning that upon completion in nine months’ time the property will be worth $790,000

- Location: Adelaide

- Purchase price: $720,000

- Rent: $720 per week, giving us a 5.5% gross rental yield

- Ownership: 50/50 arrangement

- Finance: 80% LVR

Purchase price: $720,000

Loan (80% LVR): $576,000

Deposit: $144,000

Purchasing costs: $36,000 (5% of purchase price is rule of thumb)

Total cash outlay: $180,000

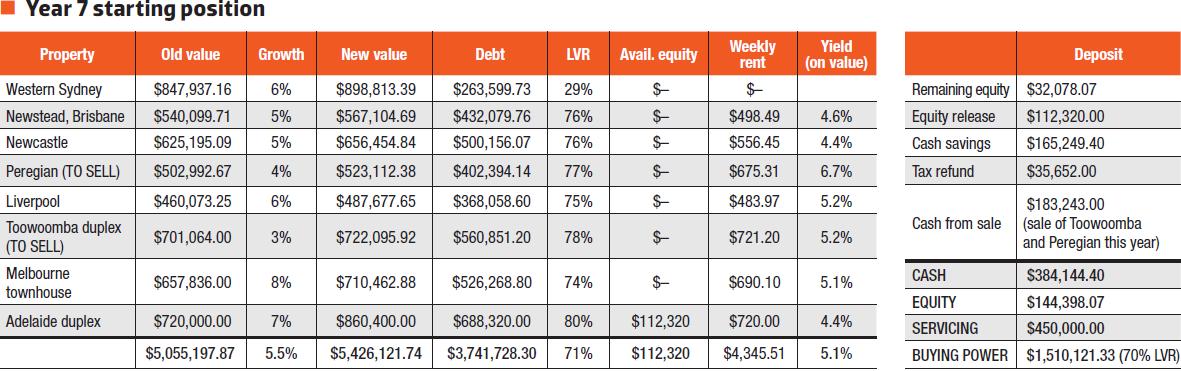

Year 7 Starting Position (Click image to enlarge)

Year 7 outlook

- It is time to move into the consolidation stage of the portfolio. Our equity position is strong but servicing is limited, at $450,000, due to the increase in the portfolio and the fact that servicing figures are now being calculated as if our interest rate sits at 6.5%.

- We will begin selling down in order to move forward. The properties on the chopping block are the duplexes in Toowoomba and Peregian. Each of these has already served its purpose, either through equity creation or yield, and can be sold to take the portfolio to its next stage.

- The other trading properties – Liverpool, Newcastle and Adelaide – are still fine to be held at this point.

- Toowoomba will be placed on the market and sold for $730,000. After capital gains tax of $38,076, selling costs of $18,250 and legal costs of $2,000, we are left with a net profit of $94,674.

- Peregian will be placed on the market and sold for $523,000. After capital gains tax of $14,918, selling costs of $13,077, and legal costs of $2,000, we are left with a net profit of $88,569.

- This gives us a total of $183,243 in cash and effectively frees up $900,000 of serviceability.

- We will use this cash for the majority of the deposit for our next deal and access the rest from equity in the portfolio. This deal is designed to create cash to eliminate the debt of our core portfolio in the future.

- At this point, we will stop accessing equity from our core properties, including Brisbane, Melbourne and Newcastle.

- Along with the remaining equity from the last equity increase we achieved, plus our ongoing savings and refunds from tax as well as cash from property sales, we will only be required to pull out approximately $112,000 of equity, which we will take from the more recent duplex deal in Adelaide. This will give us a total equity/cash position of around the $350,000 mark for the next deal.

PROPERTY 8

STRATEGY: Equity builder

PURPOSE: Fourplex build

LOCATION: Growth market with add-value opportunities

PRICE POINT: $800,000–$1.1m

YIELD: 5% is our benchmark

PROPERTY 8 DETAILS:

- Property type and strategy: Build strategy for a fourplex of units. Through the build process we expect to increase our equity on the build price by 18–20%, effectively meaning that upon completion in nine months’ time the property will be worth approximately $1.18m–$1.2m

- Location: Outskirts of Melbourne

- Purchase price: $1m

- Rent: $1,200 per week, giving us a 6.2% gross rental yield

- Ownership: Family trust structure

- Finance: 70% LVR

Purchase price: $1m

Loan (70% LVR): $700,000

Deposit: $300,000

Purchasing costs: $50,000 (5% of purchase price is rule of thumb)

Total cash outlay: $350,000

Year 8 outlook

- While completing the build of the fourplex in Melbourne, we will sell the Newcastle property we have held since Year 1. Although it is in a strong area and could represent a solid long-term investment, for the greater good of the portfolio we will liquidate it to free up further cash and servicing.

- Being in the consolidation phase, our focus is on creating equity to eliminate debt, but we are still open to having more buy-and-hold properties if they serve a purpose.

PROPERTY 9

STRATEGY: Equity builder

PURPOSE: Splitter block in 20km radius of CBD location

LOCATION: Growth market in Perth, with add-value opportunities

PRICE POINT: $800,000–$1.2m

YIELD: 5% is our benchmark on end value

PROPERTY 9 DETAILS:

- Property type and strategy: Subdivision and build strategy for a separate house. We expect to increase our equity on the build price by 18–20%, meaning that upon completion in nine months, the property will be worth approximately $1.17m

- Location: Perth

- Purchase price: $980,000

- Rent: $950 per week, giving us a 5% gross rental yield

- Ownership: Family trust structure

- Finance: 70% LVR

Purchase price: Land $500,000; build $480,000

Loan (70% LVR): $700,000

Deposit: $294,000

Purchasing costs: $49,000 (5% of purchase price is rule of thumb)

Total cash outlay: $343,000

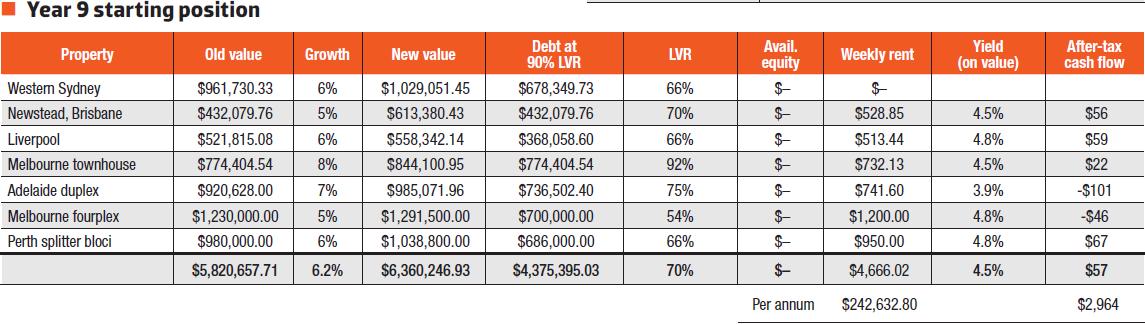

Year 9 portfolio

For these final years of the portfolio, we will just let the properties do their thing and tick along. There is nothing more for us to do except consolidate

Year 9 Starting Position (Click images to enlarge)

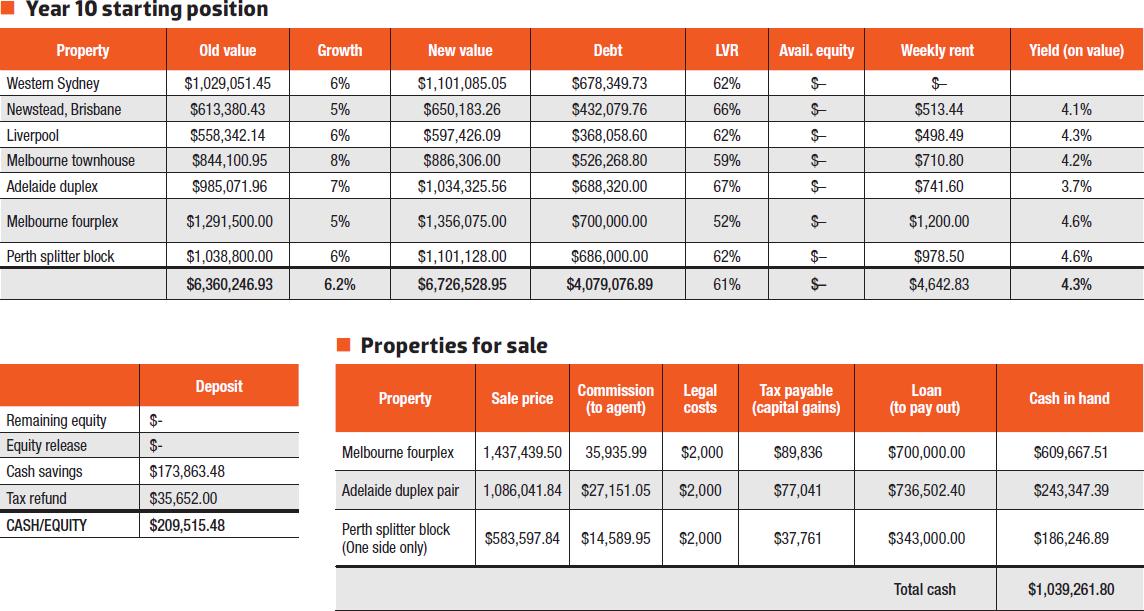

Year 10 portfolio

We made it! Year 10 - this is where we wrap things up and see the results that the last 10 years have created as we consolidate debt in the portfolio. There are a number of choices we can make with the portfolio now. We can do one of the following:

- Keep all of the properties - they are all cash flow positive after tax at this point and we can simply hold the portfolio and watch it continue to tick on. If Peter and Mandy want to continue to tick on. If Peter and Mandy want to continue working full-time, this would be a solid option.

- Sell down some properties to again release our servicing and cash and continue building the portfolio.

- Sell down and consolidate to two to four properties, preferably owned outright, or at a very low LVR.

Year 10 Starting Position (Click images to enlarge)

As you can see, we will come out with $1,039,261.80 in cash to use for debt reduction on the properties we intend to keep, including Newstead in Brisbane, the Melbourne townhouse, Liverpool, and half of the splitter block in Perth – four properties in four states. Let’s see how this plays out:

- We use the cash to eliminate the debt on Newstead and Liverpool completely, so these are now owned outright.

- With the remaining $287,000 we pay down the debt on the Melbourne property to only $287,000, which is a 31% LVR.

- We leave the property in Perth alone, sitting at a 59% LVR.

- If we wanted to reduce the Melbourne property debt further, we could of course sell the property in Perth and clear another $180,000, which would obviously bring the debt down substantially, but I don’t feel there is any need to do this.

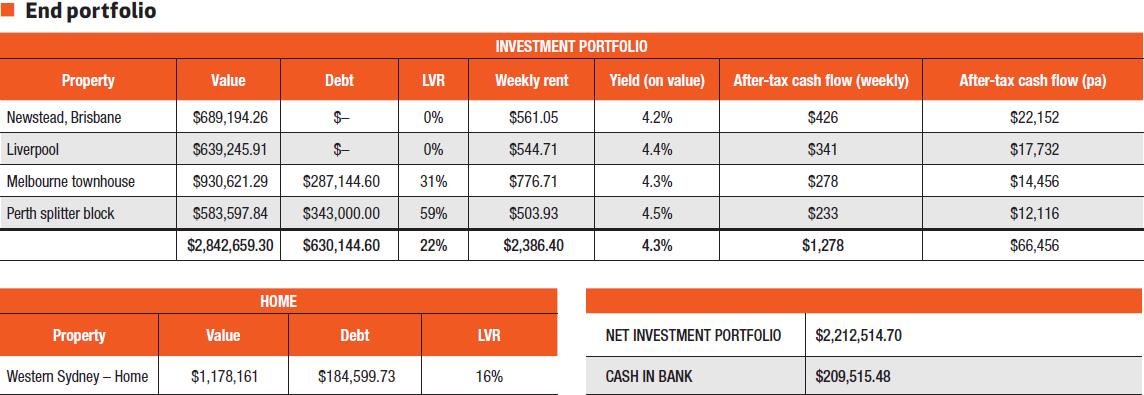

End Portfolio (Click images to enlarge)

A lot has been accomplished during this 10-year period, which I will set out below:

- The owner-occupier home is down to $184,000, and we have $200,000 in cash, which we could use immediately if we wanted to pay this debt off completely.

- Peter and Mandy have two properties owned outright and another two at relatively low LVRs. The portfolio is cash flow positive by $66,000 per annum, which is more than the average income in Australia of $57,980 (ABS).

- Peter and Mandy have reduced their tax to practically zero.

- Mandy now has the option to quit her job if she wants to and Peter can reduce his hours, while they maintain the same standard of living they are used to, and potentially moreso because their own home at this point is costing them nothing.

- We have been active in managing the portfolio, meaning we have focused on creating equity when going into deals, shifting around the country to take advantage of various growth cycles, and taking equity out and trading properties to keep the portfolio moving forward. Having said that, there was definitely more opportunity in the portfolio to go harder if we wanted to, and in addition the figures used for growth rates averaged at 5.9% growth per annum and rental increases 3% per annum in line with inflation.

This balanced strategy and conservative but active approach has set up a quality portfolio that will continue to grow into the future, ultimately providing Peter and Mandy with more and more opportunities to live out the life they truly want, unlimited by income.

Todd Polke is a property investment and wealth coach who helps people build strategic portfolios to free themselves financially and live a life on their own terms. www.toddpolke.com

Disclaimer: The information provided is of a general nature only and should be considered as general education only. Readers should not act on the information above without obtaining advice from a qualified professional person.

This feature is from the October issue of Your Investment Property Magazine. Download the issue to read more!