It's no surprise that people feel they don’t have the time they need to achieve their goals. When it comes to work-life balance, according to the OECD, Australia is in the bottom third of member countries. One in five Australian adults are so busy they don’t even have time to look after their own health. As a nation, we are clearly very time-poor.

This ‘time recession’ in Australia has given rise to a new, young breed of property investment professionals who have emerged to specifically solve this time problem for investors.

In our professional lives we analyse information, make strategic decisions, and then outsource tasks to people who specialise in a specific skill, to get superior results. We do this on a daily basis in our professional lives, but for some reason we frequently fail to use these exact same skills in our personal lives. As a result, who’s surprised we can’t achieve everything we’d like to?

Drew Evans, founder of Caifu Property, had the same experience.

“It was such an irony; I was so busy working for a property investment company that I didn’t have time to find my own investments,” he says. He saw that this was a problem all his friends were facing too, and decided he needed to solve it.

“I was sitting at my desk one day and I kind of had an epiphany. As I looked around the office, I had everything available to me that I needed.

To invest like a professional, I didn’t even need to leave my desk. Within 20 metres of me was a committed specialist who could not only advise me but more importantly execute for me every aspect of property investing that I didn’t have time for. I knew right then how I wanted to invest for the rest of my life.”

Evans implemented his plan to develop a system of becoming a hands-free property investor, and it worked. By outsourcing to different specialists, he built a property portfolio worth $3.12m in just five years. But there were important lessons he learned along the way too.

“I wanted a property portfolio that could support my lifestyle and not drain me of cash… while I was still young enough to enjoy it”

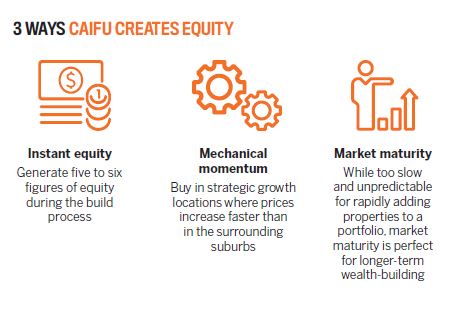

“I wanted a property portfolio that could support my lifestyle and not drain me of cash. More importantly, I wanted to achieve this while I was still young enough to enjoy it. That meant I couldn’t be a buy-and-wait investor – that was too slow.

I needed to use strategies that forced value onto a property to get me there,” he says. That narrowed Evans’ focus to either renovations or new builds to force the value he wanted.

I needed to use strategies that forced value onto a property to get me there,” he says. That narrowed Evans’ focus to either renovations or new builds to force the value he wanted.

“I didn’t have time to do a renovation, but I did have time to sign some paperwork. So new builds were the only choice.”

Outsourcing risks

Using his network and focusing on new builds, Evans was able to quickly and effectively acquire profitable properties.

“In hindsight it was obvious; of course they’d be better

at their full-time specialty than I could ever be with the time I had available. It just made sense that if I leveraged their time and skills, I’d get better results.”

Evans was able to outsource his time as well as his development risks. Thanks to the relationships he had access to because of his network, he could get contracts with builders that were unavailable to an individual.

“I wanted to build a system for clients that meant they couldn’t fail … I wanted more, and so do my clients”

“I could lock in 100% guaranteed pricing, no variations allowed. This meant cost blowouts were impossible because my builders covered the variations. We also use expensive liquidated damages to lock in our build time, so there was no time risk on my builds either,” he says.

Even as a young boy growing up in Zimbabwe, Evans was entrepreneurial and turned his hobbies into a business, like selling the fish he caught with his brother in the local markets.

That entrepreneurial spirit meant he couldn’t help but build a system to help his friends and family invest too. Now he uses the same approach with clients.

“Given the right information, busy professionals know how to make informed decisions and execute on them. That’s why they are in demand and have no time. My business takes all the legwork and time commitment off their desks so that all they really need to do is make a strategic decision on an investment, and then sign some paperwork. All the headaches are outsourced to us.”

Evans created the foundation for his system while working at a property education company. He could see that educating a client and then making them do all the hard work on their own resulted in very few success stories. “I wanted to build a system for clients that meant they couldn’t fail,” he says.

“It clearly wasn’t more education they needed – that’s not why they failed. It was leveraging the time of skilled specialists that made the difference, not talking to sales people and trainers. I wanted more, and so do my clients.”

to their portfolio every 12 to 18 months, visit: www.automaticequity.com.au