- Investors are a couple

- Their gross household income is $110,000

- They have $60,000 in savings (saved over four years)

- They have no debts or dependants

- They are currently renting at $350 per week ($18,200 per year)

- The couple is willing to do whatever it takes to accomplish their goal and intend to remain employed for the seven-year period

- Limited promotion opportunities mean the couple expect no increase in income

- The goal is their primary goal – second only to health and employment

Seven years isn’t what it used to be. Well, certainly not if you’re getting older and retirement is approaching. Time flies and, for an investment class that is considered the ultimate patience game, seven years would seem like barely enough to make any kind of money from property.

Still, wouldn’t it be handy if you could accomplish everything you wanted with property in a shorter space of time? It wouldn’t have to be just because you are retiring soon. Maybe you want to get your property purchases off the ground before you start a family. Maybe you don’t like debt. Whatever the reasons, making money in a shorter space of time would suit many people.

Does that mean it is possible?This is a question we handed to RESULTS Mentoring coach Brendan Kelly. Your Investment Property decided to invent an investment scenario of a typical couple and gave it to Kelly to see if there was any way this imaginary couple could achieve the goal of owning $1m in equity within seven years, without holding debt at the end of it. What follows is the strategy he has come up with. Think there is a way to do it? Read on to find out.

The strategy

Property investors are problem solvers. The better you are at solving problems, the more successful a property investor you’ll be. The bigger the problems you solve, the larger the profit you can expect.

Smaller problems an investor might encounter are things like a tenant reporting that the heater is broken, problems with property managers, and concerns about how to get more rent out of a property. Bigger problems are quite different. They could include things like determining how you’ll come up with a deposit for a property, or how to borrow more. A bigger problem might also include scenarios such as one in which your property hasn’t gone up in value in the years since you bought it and you have to weigh up whether to sell it or not.

It’s the solving of those bigger problems that makes or breaks an investor. If you can train your mind to come up with the solutions to some of the larger problems that come with investing, it will be a lot easier to accomplish the goal of building $1m in equity in seven years, but, most importantly, while being debt free at the end of it.

In this article, we’ll explore some ways investors can think about achieving this. Then we’ll explore an option that is a little more unconventional, but it works!

The investors

To illustrate how we could work our way towards solving this problem, let’s look at it from the perspective of a typical property-investing couple trying to get a grip on what they really want. As ambitious investors, our couple have declared themselves willing to get actively involved and ‘do whatever it takes’ to achieve their goal. This is a good thing because creating $1m through property won’t happen while sitting on the couch.

Fortunately, this property-loving couple are starting out from a conservative but solid base. Their combined income is $110,000 and they have $60,000 in savings. The latter means they have been saving $15,000 a year over the last four years.

Having no significant personal debt and being able to demonstrate regular savings over four years puts this couple in a fantastic position in the eyes of the bank to secure a loan.

Still, accumulating $1m might require some lateral thinking. The plus side is that if they can achieve $1m in accumulated equity over the next seven years, it will mean that one of them won’t need to work anymore.

Working out what to do

There are two ways to acquire $1m in equity:

- Through market-driven growth over time, as would usually be the case if your property selection has been good;

- Or growth can be generated creatively by adding more in perceived value for buyers. This includes renovating, subdividing and developing

Not too much better off, actually. Seven years of saving would add $105,000 to their pool of funds, leaving them with a total cash amount of $165,000. Of course, there would be interest payments acquired from term deposits, but even when including that the couple would still be far from their target of $1m. Saving alone won’t do it.

Option 1: Relying on market-driven growth

Not to put too fine a point on it, it is never wise to invest in the real world on the basis of market-driven growth being consistent for a property year after year. It is much safer to assume instead that there are likely to be some growth patches over the seven years our couple will be in the market.

For the sake of simplicity, let’s assume that each year they will see 5% growth in the value of their properties. This is approximately half the rate of growth needed to satisfy the common perception that property prices double every seven to 10 years. It may seem overly conservative, but if we apply this approach in the real world, we are more likely to exceed our planned expectations.

In getting started with this approach, our couple are restricted more by their deposit than their borrowing capacity. Based upon the national average for stamp duty requirements of 5% of the value of the property, and a minimum 5% deposit required by lending institutions to purchase property, the couple’s $60,000 restricts them to a property purchase totalling $600,000.

Of course, using their gross income of $110,000 alone, the couple will not have the borrowing capacity to buy a property for this much, but if a conservative rental yield of 4% from an inner-city investment is factored in, they’ll be able to borrow more than what they need.

On conservative lending measures, a maximum of 30% of joint income can be dedicated to servicing debt. Assuming the average interest rate is 8% (we can currently achieve less in today’s market, but in seven years it is likely to mirror long-term trends and be higher), our couple’s borrowing capacity would amount to $412,500.

With a 4% gross rental yield on a $600,000 property investment, the couple’s rental income will amount to $26,400 a year, provided the property is fully tenanted throughout the year. Banks generally allow 75% of the rental income to be allocated towards servicing debt. In this instance, it means the rental income alone will support $247,500 of the total debt.

In other words, our couple’s income, combined with their rental income, will more than cover all debt from a $600,000 buy-and-hold property investment (95% of $600,000 = $570,000. Total conservative borrowing capacity attainable: $412,500 + $247,500 in rents = $660,000).

While this will give us some clarity and confidence about our starting position, we need to ensure it will allow us to achieve the goal we seek for our couple.

If we purchase to buy and hold for seven years, and assume 5% capital growth, we can expect the outcome shown in Table 1.As you can see, one purchase offering 5% growth will not allow our couple to achieve $1m in seven years.

But what if we purchased a second property after three years of holding this one? Would we get our $1m then?

As a rule, banks don’t generally allow you to draw on equity for reinvesting if it is in excess of an 80% loan-to-value ratio. That means the couple would need to hold the property for six years before they would be ready to release equity and start purchasing more property. That leaves just one more year for any new property purchase to appreciate in value. Not long enough.

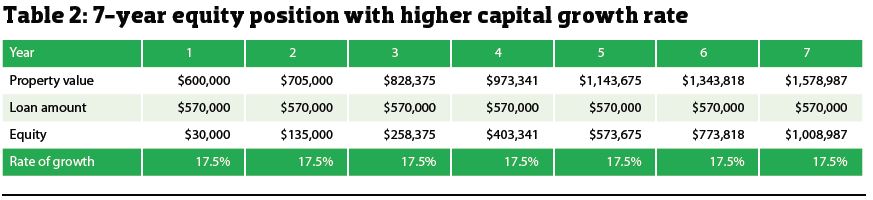

Still, what if we ditched the 5% capital growth assumption? What if capital growth was considerably higher? What assumed rate of growth would make this goal attainable?

Table 2 puts it into perspective.As you can see, if we were able to guarantee a rate of return in excess of 17.5% consistently for seven years, one purchase for $600,000 would get our couple the $1m in equity they desire.

The reality is that this is not realistic. Considering this, and our couple’s circumstances, the traditional method of holding property for growth will not deliver the outcome they seek.

Option 2:

Adding value through renovations:

To illustrate how a renovation project might work out, let’s look at a summary of the typical numbers for a cosmetic renovation project worth $240,000 (a project the couple can easily afford).

Explanation of terms

Purchase costs: These are the costs required for you to settle on the purchase of the property. They are different in each state, but as a national average it’s approximately 5%.

Renovation costs: This is the maximum you can afford to spend on your renovation if you want to walk away with a profit that will make the project worth doing.

Profit: If you stick to budget in terms of both time and money, then this is the amount of cash you’ll have increased your bank balance by within six months, provided you sell the renovated property for the nominated price (excluding tax).

Selling costs: These are the costs typically associated with selling a property through your local real estate agents.

Selling price: The most critical number by far! If you don’t believe your renovated property will sell for 33% more than you are looking to purchase it for, don’t buy the property!

Given that our couple has $60,000 in cash and $412,500 in borrowing capacity, using the value-adding approach they can afford to purchase an unrenovated property for $240,000 on a 95% lend and see the project through to completion.

This would happen without affecting their cash flow or current lifestyle. If done right, it would afford them a pre-tax profit of $24,000.

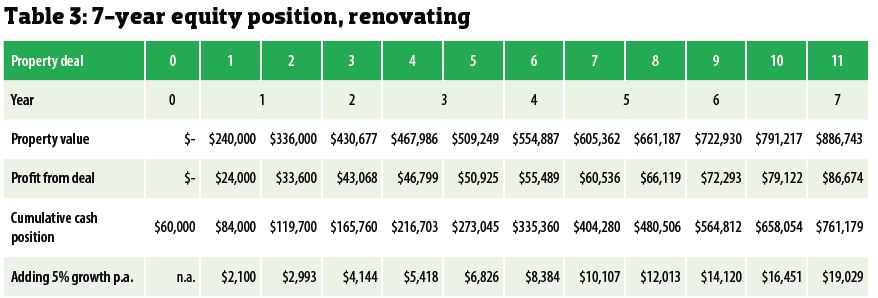

If they were to do a cosmetic renovation every six to nine months, reinvesting their accumulated cash into bigger and more expensive properties to increase their profits, $1m in equity within seven years would be somewhat more attainable. Here’s how:

If our couple take the profit from the first purchase ($24,000) and add it to their savings ($60,000), they will end up with $84,000 cash to play with. With their borrowing limit of $412,500, they can afford a property purchase of $336,000.

Read on to find out how their second reno project might go down.The numbers at right illustrate the profit potential of a second reno project.

Continuing with this reno approach, assuming the same borrowing capacity, our couple could eventually reach the equity position shown in Table 3. In other words, even if we apply growth, we get close, but we are not quite there yet. This means even more creativity is required to solve this problem.

Option 3: A third approach – that works

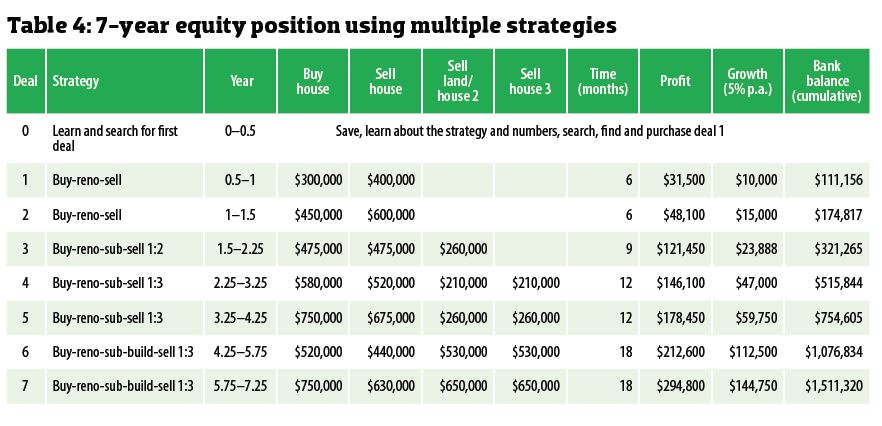

As we begin to think differently, there are numerous ways to achieve our objective. Let’s say our couple has now purchased a few unrenovated properties, done them up cosmetically, sold them and made their targeted profits along the way. How might they begin to build on what they know? What about another strategy?

Land subdivisions are not too difficult. There are things you need to know and traps for new players, but in essence it’s not a difficult strategy to execute. Better yet, it’s a strategy that can be combined with other approaches, such as buying-renovating-subdividing and selling.

When you ‘boil’ property right down to its core function, it’s all about people. If you can satisfy more people with your property or give those who want to use your property a better experience, you will be paid more.

The renovation is all about providing a better experience, and the subdivision is all about being able to satisfy more people. In fact, you would typically expect to create a profit in the order of 20% of the purchase price for a reno-subdivision, against a 10%-of-purchase-price profit for simply undertaking the cosmetic renovation. As a result, we have amplified our couple’s productivity and capacity to profit through property.

Building on what we know, if we were able to renovate and subdivide, what might be next? Perhaps build something on the backyard block we’ve created?

If our couple build on what they know, with consistent activity towards finding and managing their deals, there is every opportunity to achieve an equity position of $1.5m after seven

years of doing property purchases one after another. Let’s not forget, though, that we would need to pay tax along the way. But since each individual’s tax circumstances differ, it would be unwise to attempt to address the couple’s circumstances here. With $1.5m in projected profit in seven years, and consistent application to their investing goal, I think their tax bill would be covered!

Disclaimer: This article is of a general nature only. The value of taxes payable is not discussed in any detail within this article and it is written for the purpose of demonstration and education. It should not be considered as legal or tax advice.