PROPERTY INVESTING has long been part of life for Angela and Lance Santalia.

Angela, a freelance financial paraplanner, and Lance, who has a background in construction and real estate, purchased their first home together before they were married.

They invested time and energy in cosmetic renovations and today they still own that first home as a rental property.

“The renovation and capital growth we have enjoyed from that inner-city gem of a property allowed us to secure the next property, and we were able to grow our portfolio from there,” Angela says.

It was from this early positive experience that Angela and Lance crafted their long-term property investing strategy, which they hope will eventually allow them to hang up their hats in the workforce and travel the world.“Our aim is to eventually have around $200,000 per annum of passive income. Our idea is to accumulate around 20 properties, then sell 10 over the long term to pay down the debt, leaving us with 10 properties with no debt. Assuming a conservative rent of $380 per week on average, we would achieve that goal.”

When work and weekends collide

Many investors find their interest in property is piqued during the course of their day job, and for Angela it was no different.

“Through my work, I developed a big interest in investing in general. Lance and I wanted a piece of the action as we love to travel and want to be able to retire early,” she says.

“We saw for ourselves how quickly adding value could compound returns and speed up the journey”

After their fi rst successful renovation project, “we saw for ourselves how quickly adding value could compound returns and speed up the journey”, Angela adds.

“Our investing technique is to add value to create immediate capital gains, and to select properties in areas that are starting gentrification and those which have a specific rental yield,” she explains.

“This combination keeps our rate of return higher than average, which helps our portfolio to have healthy cash flow and growth, to protect us during times of market fluctuations and help repay the debt without relying on our personal income. The initial growth that we manufacture helps us to move on to the next property.”

They have tackled a number of different projects over the years, including at one stage investing in a single block of land with a lone inhospitable, burnt-down house on it.

The state of the decrepit old house was of no concern to them, as they demolished it and transformed the site into a triplex of glamorous new villas.

This strategy is now their preferred method for driving property profits, Angela says.

“Although we have purchased established properties, renovated and built new properties, our love is in small- to medium-density developments. Triplexes are ideal for us,” she says.

“We favour ugly-duckling suburbs in the inner-city ring to middle ring, rather than the CBD, which are at the start of gentrification. The end value of each dwelling, usually a villa, is in the $400,000–$500,000 price range, with a minimum profit of $50,000 per dwelling in our feasibility.”

Sourcing ugly-duckling suburbs

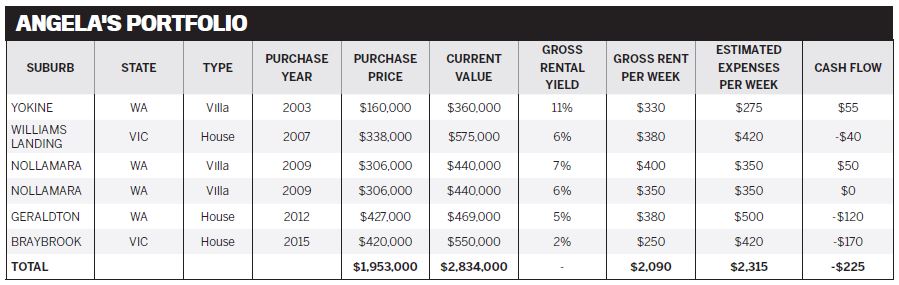

In just over a decade, Angela and Lance have amassed wealth of more than $1m through property investing, but it hasn’t always been smooth sailing. With a number of investments in Perth, for instance, they have been negatively impacted by the resources downturn.

“Rents have significantly dropped in Perth for the last couple of years, and we have since hired real estate agents to manage the properties, which comes at a cost. However, overall, we have a much smaller negative cash flow now than most [investors in Perth],” Angela says.

“The quality of the properties that we have picked have done us well over the years, and we had an overall positively geared portfolio for a long while.”

With a knack for picking uglyduckling suburbs just at the start of gentrification, Angela says their investment choices to date have allowed them to enjoy the benefits of capital appreciation at the same time as manually adding value through renovation or development, which provides an extra barrier against risk.

“At times we’ve been happy that our research may have taken too long or that finance wasn’t possible, because in a couple of instances property prices have in the meantime become too hot, or another reason appeared for us not to proceed – which saved us a couple of times from buying incorrectly. Hindsight later showed us, and we have been very grateful!”

Angela also admits that initially she wasn’t 100% clear on her property goals. For instance, she didn’t always intend to hold on to her real estate assets for the long term.

However, over their years in the property game, the couple have learnt the value – quite literally – of being in it for the long haul.

“Some properties were slow to increase in capital growth in the first few years, then shot up in the fourth or fifth year by as much as $150,000,” Angela says.

“We started with nothing, and are very proud of our portfolio. We love the creative side to buying an existing house and renovating to add value, or buying an old house, demolishing and developing. It’s rewarding to see the before versus after, whilst also knowing that we are creating a sound financial future for ourselves.”

– Elvio Bechelli, Defence Housing Australia

– John Kovacs, NMD Data

JOINT VENTURE INVESTMENT

Angela and Lance completed their first triplex development, in Nollamara, WA, with their best friends, who are also property investors. “The initial property purchase was negotiated with the agent whilst we were in the middle of a restaurant having dinner!” Angela laughs.

The project went smoothly and on completion Angela and Lance kept two of the properties and their joint venture partner kept one. Everyone walked away with fantastic profits in their back pockets:

• Cost of the block = $350,000

• Total cost including buying costs = $379,000

• Total cost to build 3 x 3-bed, 2-bath dwellings = $539,000, including mortgage interest

• Total cost of development = $918,000

• End value of the development at completion = $1,200,000

• $282,000 profit = 31% ROI

• Current value $1,320,000 = 44% ROI

As a Highly Commended finalist in the 2016 Investor of the Year Awards, Angela wins a fantastic prize pack worth $2,215, including:

- $100 eftpos® card from DHA Australia

- A full 4-month membership of Real Estate Investar’s Portfolio Builder, allowing subscribers to manage, track and optimise their portfolios' performance with powerful and easy-to-use tools. Valued at $996

- A platinum 12-month membership of NMD Data, the online property listing website that exclusively lists mortgagee foreclosure, deceased estate and housing authority properties. The only comprehensive national database of its kind in Australia, valued at $199

- A 12-month subscription to Your Investment Property, and a selection of our bestselling special reports and e-books, valued together at $889.85

- A copy of the bestselling book, The Armchair Guide to Property Investing, by Ben Kingsley and Bryce Holdaway