The economic fallout of the Covid-19 pandemic saw mass job losses and plummeting incomes - but it was an entirely different story for Australia’s billionaires.

While 99% of people across the world are financially worse off since the virus began, Australian billionaires “have had a terrific pandemic” with their wealth rocketing over the past two years, according to a new report by Oxfam.

Astonishingly, the wealth of Australia’s 47 billionaires has doubled to $255 billion at a rate of $2376 per second or more than $205 million per day during the first two years of the pandemic.

That means Australia’s billionaires hold more wealth than the poorest 30% (or 7.7 million) of Australia’s population combined.

This shows that wealth inequality is worse than ever before.

And this isn’t just happening in Australia, the phenomenon spreads worldwide.

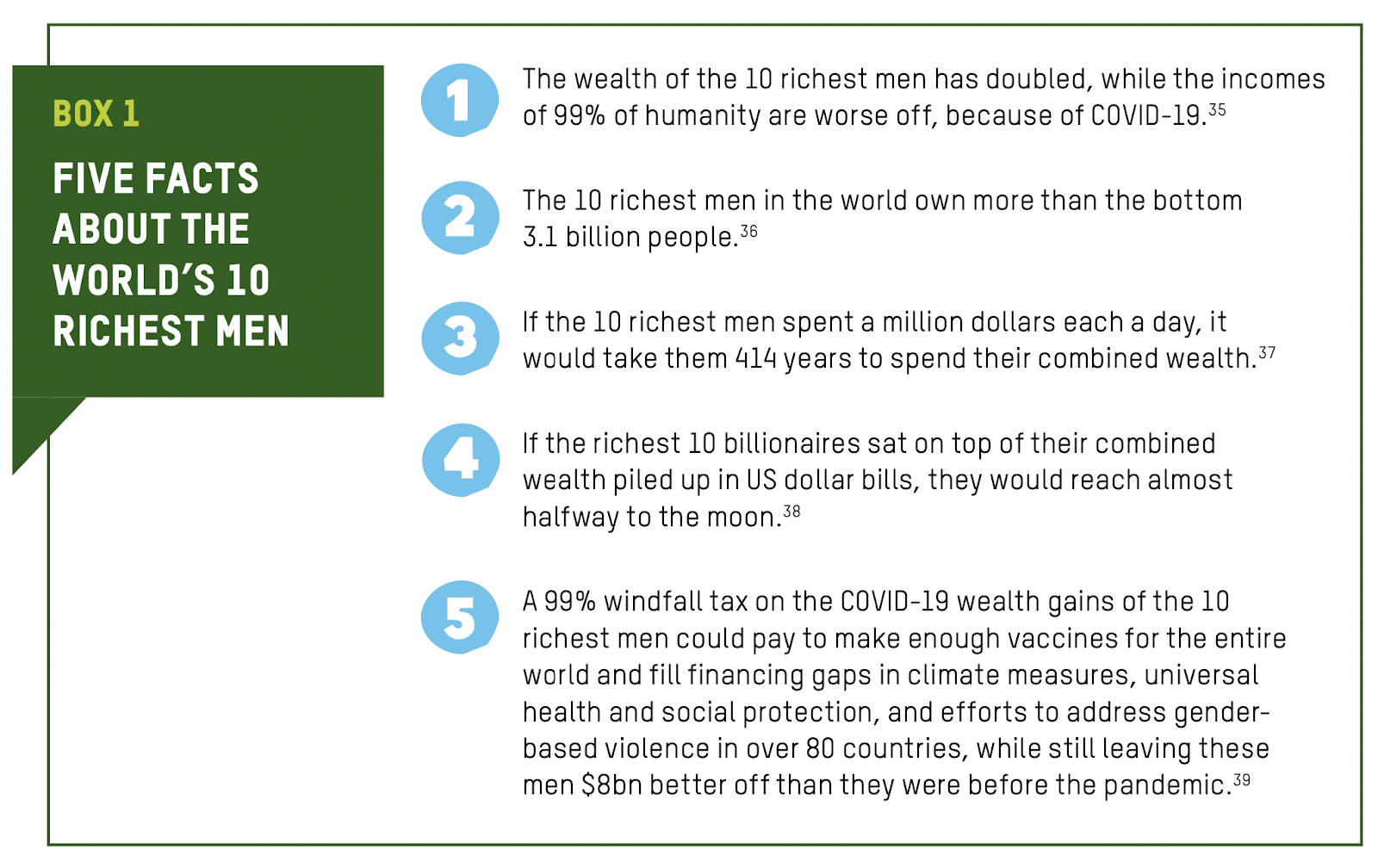

The report found that the world’s 10 richest men have more than doubled their fortunes to $1.9 trillion during the pandemic - that’s a rate of $1.6 billion per day.

This is also the biggest annual increase in billionaire wealth since records began.

Source: Oxfam

Unfortunately at the other end of the scale, over 160 million people have been pushed into poverty and an estimated 17 million have died of the virus, a scale of loss not seen since the second world war.

Billionaire bank accounts boosted

So, how has this happened?

When businesses were forced to close and workers plunged into isolation, central banks around the world slashed interest rates to record lows and pumped $16 trillion into financial markets to keep the economy afloat.

But the huge amount of public money pouring into our economies ended up inflating property and stock prices so drastically that it only boosted billionaire’s bank accounts more than ever before.

“It is enabled by skyrocketing stock market prices, a boom in unregulated entities, a surge in monopoly power, and privatisation, alongside the erosion of individual corporate tax rates and regulations, and workers’ rights and wages - all aided by the weaponization of racism,” the report says.

At the same time, huge amounts of public money, poured into vaccines, have in turn boosted the profits of pharmaceutical firms, to the tune of tens of billions of dollars.

“The record-breaking nature of the growth in their wealth means that while many have been pushed to the brink, billionaires have had a terrific pandemic,” Oxfam Australia Chief Executive Lyn Morgain said.

“Central banks have pumped trillions of dollars into financial markets to save the economy, yet much of that has ended up lining the pockets of billionaires riding a stock market boom.”

Tax the wealthy

Now, Oxfam is pushing for the Australian government, and others around the world, to introduce a wealth tax on the mega-rich.

“All governments should immediately tax the gains made by the super-rich during this pandemic period, in order to claw back these resources and deploy them instead in helping the world. For example, a 99% one-off windfall tax on the Covid-19 wealth gains of the 10 richest men alone would generate $812 billion,” the report states.

The report shows how extreme inequality is a form of economic violence, where policies and political decisions that perpetuate the wealth and power of the privileged few result in direct harm to the vast majority of people across the world, particularly in countries where Oxfam works.

“Inequality at such pace and scale is happening by choice, not chance,” Morgain said.

“Not only have our economic structures made us all less safe in this pandemic, they are actively enabling those who are already extremely rich and powerful to exploit this crisis for their own profit.”

The report also notes the significance of the world’s two largest economies - the US and China - starting to consider policies that reduce inequality, including by imposing higher tax rates on the rich and taking action against monopolies.

“Here in Australia, and globally, there is a shortage of the courage and imagination needed to break free from the failed, deadly straitjacket of broken economic systems,” Morgain said.

“It’s time for the Australian Government to take this issue seriously and take action to close the gap between the rich and poor.

We have calculated that an annual $30 billion wealth tax would have a massive impact.

“For example, it could cover close to half the cost of achieving the World Health Organization’s mid-2022 vaccination goal for lower income countries, helping protect all people, including Australians, from further variants and preventing millions of people around the world being pushed into greater hardship and poverty,” she said.

....................................................

Kate Forbes is a National Director at Metropole Property Strategists. She has over 20 years of investment experience in financial markets in two continents, is qualified in multiple disciplines and is also a Chartered Financial Analyst (CFA).

Kate Forbes is a National Director at Metropole Property Strategists. She has over 20 years of investment experience in financial markets in two continents, is qualified in multiple disciplines and is also a Chartered Financial Analyst (CFA).

She is a regular commentator for Michael Yardney’s Property Update

Read more Expert Advice from Kate here!

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.