New research from Commonwealth Bank and Deloitte reveals that financial abuse costs victims, and the Australian economy, more than $10 billion per year.

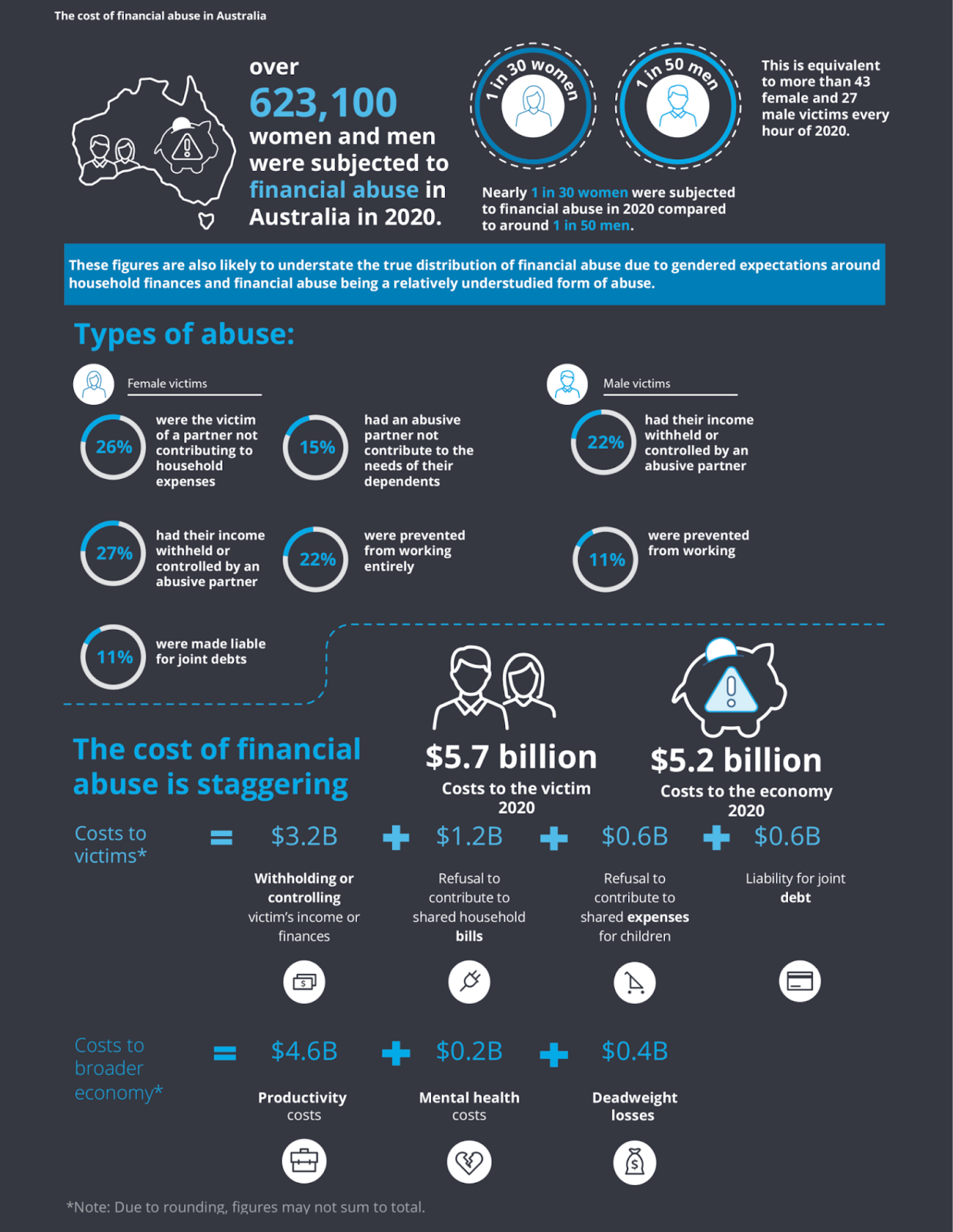

The staggering research found that over 380,000 women and 240,000 men were subjected to financial abuse by a former or current partner in 2020.

That is 1 in 30 women and 1 in 30 men.

Financial abuse is where a perpetrator seeks to control or sabotage their partner’s financial resources, and experts say the behaviour can be a precursor to domestic or family violence.

Some examples of financial abuse noted in the research include:

- Withholding wages or income

- Refusing to allow a partner to work

- Forced early access to superannuation during the Covid-19 pandemic

- Cancellation or alteration of insurance policies, often coinciding with property damage

- Deliberately causing housing insecurity by damaging property or not making rent or mortgage payments.

Breaking down the costs

The research reveals that financial abuse has cost victims a huge $5.7 billion, and cost Australia’s economy another $5.2 billion.

The 'staggering' $5.7 billion cost was broken into four main categories;

- Withholding or controlling victim's income or finances ($3.2 billion)

- Refusal to contribute to shared household bills ($1.2 billion)

- Refusal to contribute to shared expenses for children ($0.6 billion)

- And liability for joint debt ($0.6 billion).

The $5.2 billion cost of financial abuse on the economy comprises $4.6 billion in the form of productivity costs, $200,000 in mental health costs and $400,000 in deadweight losses.

Source: Commonwealth Bank

Commonwealth Bank CEO, Matt Comyn, said that financial abuse is one of the most powerful ways to keep someone trapped in a domestic and family violence situation.

“It [causes] victims and survivors serious financial stress both during the situation and for some time after they leave. It’s a hidden epidemic in our country that has directly affected one in four Australian adults, and we want to change that,” he said.

Commonwealth Bank to end financial abuse

To help fight the abuse, Commonwealth Bank has launched the Commbank Next Chapter Commitment to raise awareness on financial abuse within the family.

Since the launch of Next Chapter in 2020, CBA has helped more than 500 customers through the Financial Independence Hub, a free and confidential service that aims to support financial abuse victims to feel more confident with money.

In 2021, another 22,000 customers suffering from family violence were assisted through CBA’s Community Wellbeing team.

“The Next Chapter Commitment will see CBA…providing tools, advice and access to support services to help individuals or people they know recover from financial abuse and establish financial independence,” Comyn said.

“It will take a community effort to address this hidden epidemic and this new commitment is one way we are playing our part. We want to help create a brighter future for all Australians, a future free of financial abuse.”

In late 2021, the Commonwealth Bank became one of the first banks in Australia to implement artificial intelligence (AI) and machine learning techniques to detect abusive behaviour in transaction descriptions within the CommBank app and internet banking.

"Since we began work on financial abuse in 2015, we now better understand the extent of this issue and the devastating impact it has on victims, survivors and the community," Comyn said.

.....................................................

Kate Forbes is a National Director at Metropole Property Strategists. She has over 20 years of investment experience in financial markets in two continents, is qualified in multiple disciplines and is also a Chartered Financial Analyst (CFA).

Kate Forbes is a National Director at Metropole Property Strategists. She has over 20 years of investment experience in financial markets in two continents, is qualified in multiple disciplines and is also a Chartered Financial Analyst (CFA).

She is a regular commentator for Michael Yardney’s Property Update

Read more Expert Advice from Kate here!

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.