Australia's housing slump could turn into the 'longest and deepest” property downturn in modern history.

Property values are falling around the country for 17 consecutive months, but the actual rate of decline has been easing over the past three months.

According to Corelogic, Australian home values have returned to levels last seen in September 2016, these declines are concentrated in our 2 big capital cities, while regional dwelling values have not fallen anywhere near as much.

So how much lower will property prices fall?

Are we near the bottom or should buyers hold off and wait?

To get an understating of what’s going on in the market let’s do a Q&A to find out what’s ahead

Q: What’s actually happening to property values around Australia

A: The media is having a field day with gloomy house price forecasts, aren’t they?

But what are our property markets really up to?

Well, it depends on which market you’re talking about, as some are performing much better than others. It also depends if you’re a buyer, a seller or a long-term investor.

The current downturn is related to various factors, including:

• Decreased investor activity, with local investors having difficulty obtaining finance due to the bank’s credit squeeze, at a time of higher supply of new and off-the-plan properties;

• Fewer overseas investors due to financial difficulties as a result of us having pulled the welcome mat out from under them with increases taxes and fees;

• Decreasing consumer confidence causing home buyers to go on strike;

• A sharp economic slowdown, and

• Uncertainty about the outcome of the upcoming federal election and the potential tax changes.

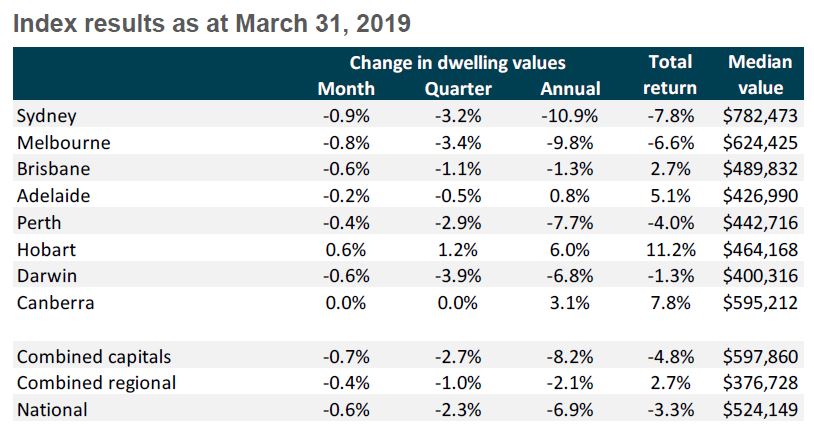

In March 2019, dwelling values were 0,6% lower across all capital cities the 0.6% which was actually the smallest of the month-on-month declines since October last year.

Over the past year, combined capital city dwelling values were 8.2% lower and combined regional market values were 2.1% lower.

But, as always, some areas are outperforming, including some regional areas such as Geelong as well some of our capital cities such as Hobart Canberra, Adelaide and Brisbane.

Source: Corelogic

Q: How far will the markets fall – will they crash?

A: How far property markets will fall will depend a lot on consumer confidence, the availability of finance, interest rates and whether Labor introduces its proposed raft of taxes.

The overall Melbourne and Sydney property markets could fall 15% percent from peak to trough, but our markets are fragments meaning some segments of our real estate markets will fall more than others while others will hold up well.

Those segments likely to suffer most will be:

1. Prestige property markets – the most expensive properties in our cities always suffer more at this stage in the cycle.

2. Off the plan apartments and new apartments are feeling the brunt of decreased lending to investors.

In fact, thousands of investors face financial ruin because they won’t be able to settle the “off the plan” apartments they signed up to buy.

Almost half of the new apartments settled in the last few months with valuations which were undertaken at the completion of the project so the purchaser could obtain finance —were below the off-the-plan purchase price, up from 18 % a year ago.

3. House and land packages in the outer suburbs

Availability of finance will be an issue for many first home buyers who are struggling to save a deposit.

4. Holiday homes

This is really discretionary spending.

Q: How long will this downturn last?

A: This will depend on a number of factors, including:

• Whether the RBA stimulates our markets with interest rate cuts – which I see as likely.

• Whether we get a change of government and Labor introduce changes to negative gearing and CGT. Both will be negative for our markets, but there is likely to be a surge of investor activity getting in before the introduction of the tax changes.

• The stimulatory effect of any election promises.

• A likely surge in investor activity in the second half of this year now that the ALP has announced January 1st 2020 as the day they will commence negative gearing and CGT changes.

Q: What happened in previous downturns – what can we learn from the past?

A: At a national level, since 1980 there have been eight separate housing market downturns

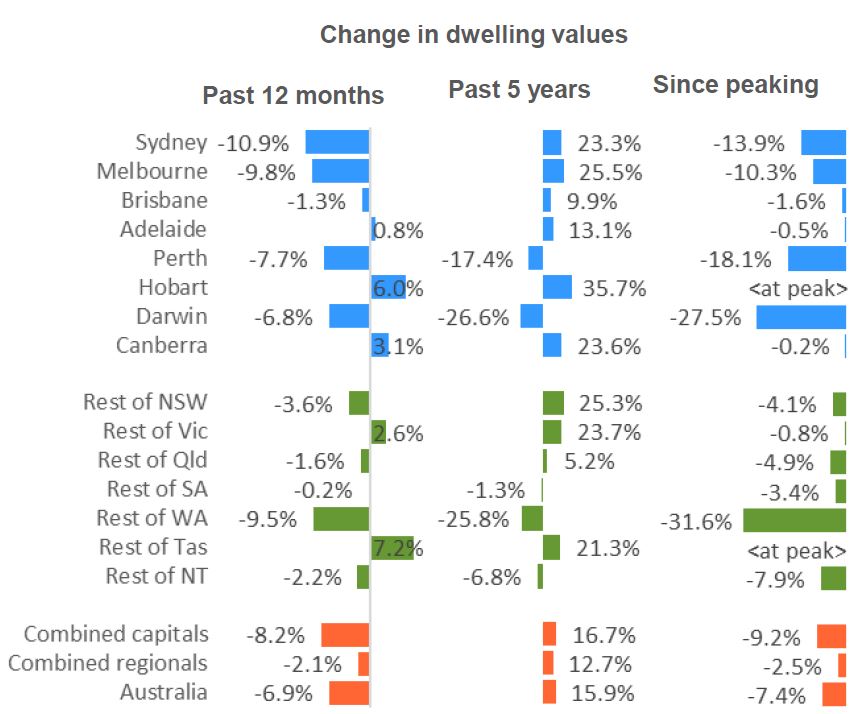

Sure some markets such as Perth and Darwin have been in the slump phase of the property cycle for 5 years, but when looking at the Australian property market as a whole, the current downturn commenced in mid 2017 and has seen values fall by 7.4% nationally.

While this may not seem like a substantial downturn, since the early 80’s there have only been two downturns which were larger, 2008-09 and 1982-83.

Source: Corelogic

National housing market downturns have also been generally fairly short-lived with the current downturn of 17 months already being the second longest with the 2010-12 decline running two months longer than the current downturn.

That means this is likely to be the 'longest and deepest” property downturn in modern history.

In every other recent property downturn the RBA has stepped in to lower interest rates to stimulate home buyer and investor activity.

But these previous property slumps were associated with either general economic downturns and or a period of high interest rates.

This downturn has been brought about by a credit squeeze - a significant tightening of credit conditions at a time in which the overall fundamentals are sound, the economy continues to grow, employment growth is high and interest rates are low.

Q: So when will the market bottom?

A: Remember…there is not one property market and some markets around Australia are still performing well and even certain suburbs and submarkets in Sydney and Melbourne are holding their own.

However overall it is likely, at least for the short-term, for property values to continue trending lower, with but with the rate of decline easing.

We started the year with two big challenges facing our property markets – The Haynes Royal Banking Commission and the Federal election.

The first has come and gone with minimal impact on property and once the uncertainty of the Federal election is out of the way, how our housing markets will perform will depend on the return of consumer confidence.

Some economists are forecasting our markets to turn in the last quarter of 2019 while others suggest this won’t happen till early 2020.

Historically, market recoveries have generally been fairly rapid because they have been driven by lower interest rates or a raft of government stimuli such as the first home buyers grant boost.

Q: Should I put off buying my next property till we reach the bottom? How will I know

A: It really depends on your circumstances.

This is a great time to buy your first home with less competition from property investors and the opportunity for assistance of government grants.

It’s also a good time to upgrade your home because even though your current home may have lost some value over the last few years, the home you’re upgrading to will most likely have lost a little more. So you win.

As for property investors, trying to time the market is a flawed strategy.

Financial modelling has shown that the most important factor in a property’s long term performance is it’s rate of capital growth.

Buying cheaply or timing the market makes minimal difference to its performance in the long term.

Imagine you managed to save $50,000 buying your $700,000 investment property by timing the market or snaring a bargain.

Fast forward 20 years and, if your property is well located in a high growth “investment grade suburb, it is likely to be worth over $2million.

That $50,000 saving you may, or may not, make today will be insignificant in the scheme of things.

The bottom line is…it’s more important to focus on the quality of your asset than timing and then hold your investment for the long term and allow leverage and compounding to work its magic.

..........................................................

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Michael Yardney is CEO of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.