While the prospect of investing in property through your self-managed super fund may seem complex, the benefits may outweigh the challenges

Many changes have been happening in the superannuation space, making the prospect of investing in property through a self-managed super fund (SMSF) seem complicated. However, there are still multiple benefits to running your own super fund, says CPA Ken Raiss, director of Metropole Wealth Advisory. He suggests investors get specific advice from a qualified accountant before embarking on an SMSF journey, and outlines some of the key benefits of building a property portfolio through a super fund.

- Multiple members

An SMSF allows a trustee to consolidate the super assets of up to four members (usually family members or business partners) into one larger pool of funds, which increases their investment opportunities. Furthermore, SMSFs allow greater flexibility for multiple members to run a mixture of accumulation and pension accounts. Trustees can adjust their investment mix as it suits them, allowing for a fast response to changes in market conditions, super rules or personal circumstances.

- Flexibility

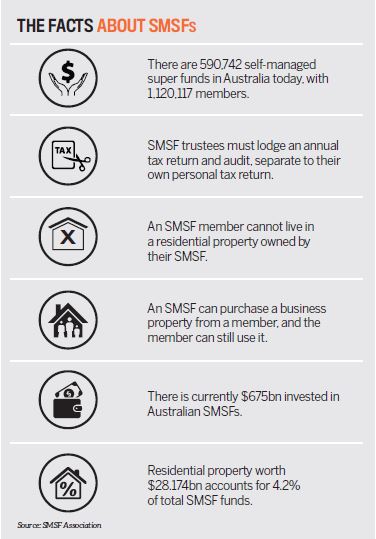

SMSFs can provide flexibility, offering more investment options. In addition to property assets, trustees can invest directly in shares, high-yielding cash accounts, term deposits, income investments, direct property, unlisted assets, international markets, collectables, and more. SMSFs can even borrow to purchase your business premises, though it’s important to understand that an SMSF member can’t live in a residential property owned by their SMSF. An SMSF can purchase a business property from a member (and the member can still use it), but it can’t purchase residential property from a member.

- Tax effectiveness

Like all super funds, SMSFs benefit from concessional tax rates. In the accumulation phase, tax on investment income is capped at 15%; in the pension phase there is no tax payable, not even capital gains tax. Carefully considered tax strategies can help trustees grow their super savings and reduce tax payments as they transition to retirement. At the same time, the cost of administration can be reduced by using an SMSF. While SMSF trustees must lodge an annual tax return and audit, and pay ATO fees, the costs are based on the time taken to prepare these and not on a percentage of your super balance. This means that the more an SMSF grows, the more cost effective it becomes.

If so, to learn about the benefits of a Self-Managed Super Fund. click here

It’s no surprise that “more and more Australians are opting to take control of their superannuation and setting up self-managed super funds”, Raiss says.

“In fact, there are nearly 600,000 SMSFs in Australia. That’s a lot of people who understand the benefits of controlling their superannuation. It’s no secret, however, that the superannuation landscape can be complex.” For this reason, it is strongly advised that investors considering borrowing through an SMSF should obtain professional guidance before they establish their own super fund, as well as during its ongoing management.