From market performance to rental appeal, there are countless elements to consider before investing in property. However, one of the most important factors has less to do with the building itself and much more to do with the land it’s sitting on.

“The golden rule is that land appreciates over time while buildings depreciate,” says Kosta Maltaris, an investment consultant at OpenCorp. “It comes down to the fact that we can’t make any more land.”

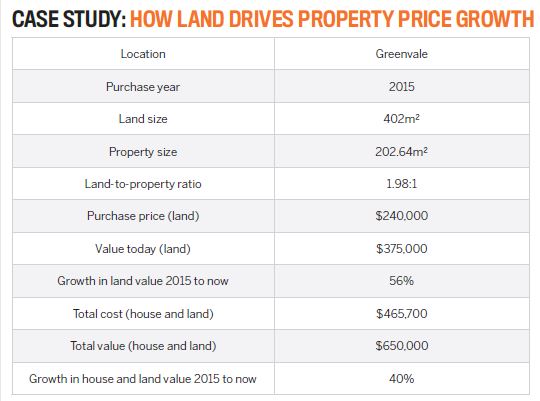

While there’s no golden ratio, Maltaris says there is a simple principle that investors should follow when trying to figure out if a property has enough land to be profitable.

“For us, our rule of thumb is that the total floor area of the building has to be less than the land,” says Maltaris. “So if the block size is 400sqm and the house is 200sqm, that’s a good ratio of 2:1.”

It’s for this reason that Maltaris always steers investors away from small units and apartments, no matter how attractive they might seem or how close they may be to a city centre.

“With apartments, you’ve got the majority of the value in the depreciating part of the asset – the building,” he explains. “You can easily end up with a ratio of 1:10 or even less with high-rises.”

However, finding a property with an abundance of land won’t guarantee long-term success; investors also have to take into account the surrounding area.

“Land is important but only in those infill areas where there is limited supply. You don’t want to be going into areas where there is ample land supply still to come, because the demand will never really increase and that won’t put pressure on prices,” Maltaris says.

“You also want lots of owner-occupiers, low vacancy rates, good proximity to all the essential amenities, and it needs to be in a desirable and stable area.”

“Land appreciates over time, while buildings depreciate. It comes down to the fact that we can’t make any more land”

Clearly, identifying such a property is rarely easy – and almost impossible if investors are limiting themselves to locations close to home.

“People buy emotionally, around the corner from where they live, because it makes them feel comfortable,” says Maltaris.

“I was guilty of that myself when I first started, but I soon learned that being able to drive past and see the property certainly won’t determine how it performs.”

Instead, Maltaris says investors will only succeed if they follow a proven system that looks at key market indicators such as population growth, jobs growth, wages growth, unemployment rates, and undersupply of property at a macro level.

“It is hard to find the ideal investment opportunity, but we’ve got a dedicated research team who keep a very close eye on the four key cities – Sydney, Melbourne, Brisbane and Perth – and we’ve done extensive due diligence across those cities,” Maltaris says.

Learn more about the importance of land over property, and find out how OpenCorp could help you on your investment journey.

Ph. 1300 OPEN CORP (649 564)