Some bank economists are predicting that house prices will fall this year or in 2023 as interest rates increase, but property market analyst John Lindeman explains why property prices will continue to rise.

Economists are concerned that the Reserve Bank will soon raise interest rates to slow down inflation because inflation is very hard to reign in once it takes hold. They believe that higher interest rates will make housing less affordable, and that lower buyer demand will then push prices down.

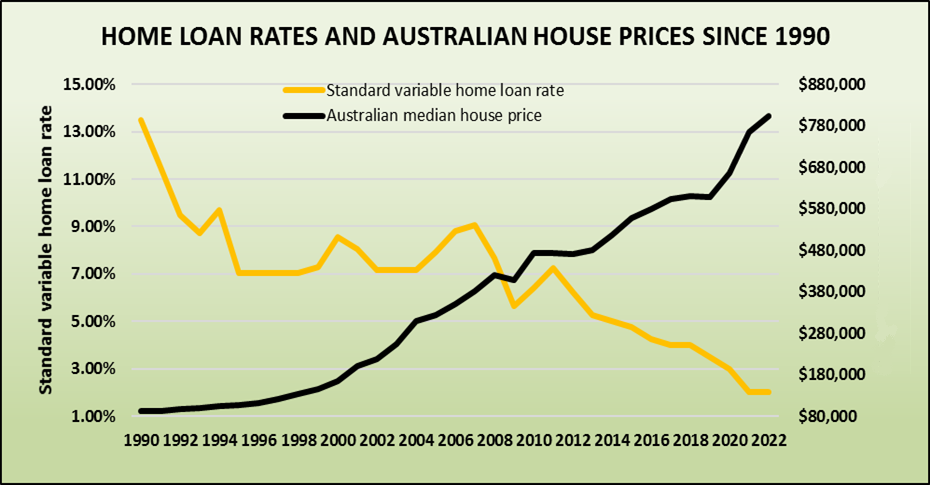

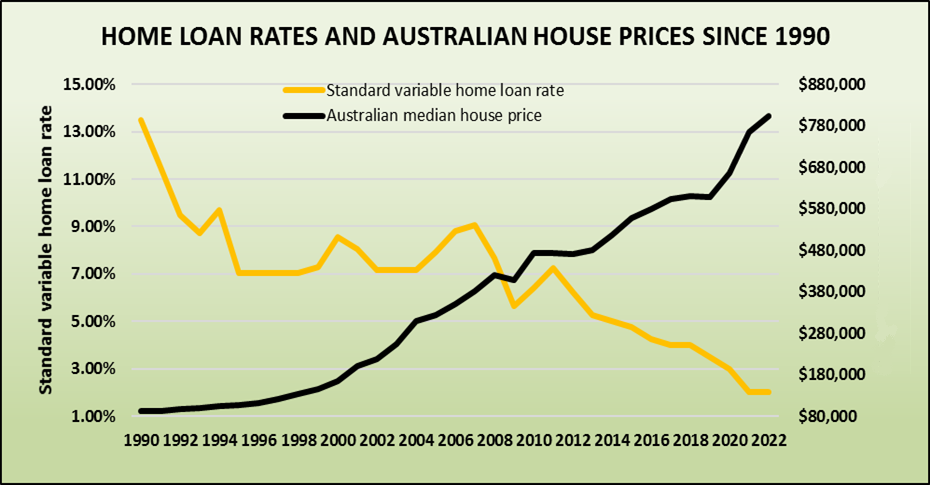

It seems to make sense that higher borrowing costs will reduce buyer demand and therefore prices will fall. But, it’s hard to test this theory, because interest rates have gradually declined since 1990 when the standard variable home loan rate was an eye-watering 13.5%.

For over 30 years property prices have grown and interest rates have fallen

The graph tracks this gradual fall in loan rates since 1990 and shows that it has been accompanied by a steady rise in Australian median house prices over the same time.

There certainly is a strong correlation between falling interest rates and rising property prices, but does this mean that the reverse is also true? How can we be sure that if interest rates rise, property prices will fall?

In the last 30 years, property prices did not fall when interest rates rose

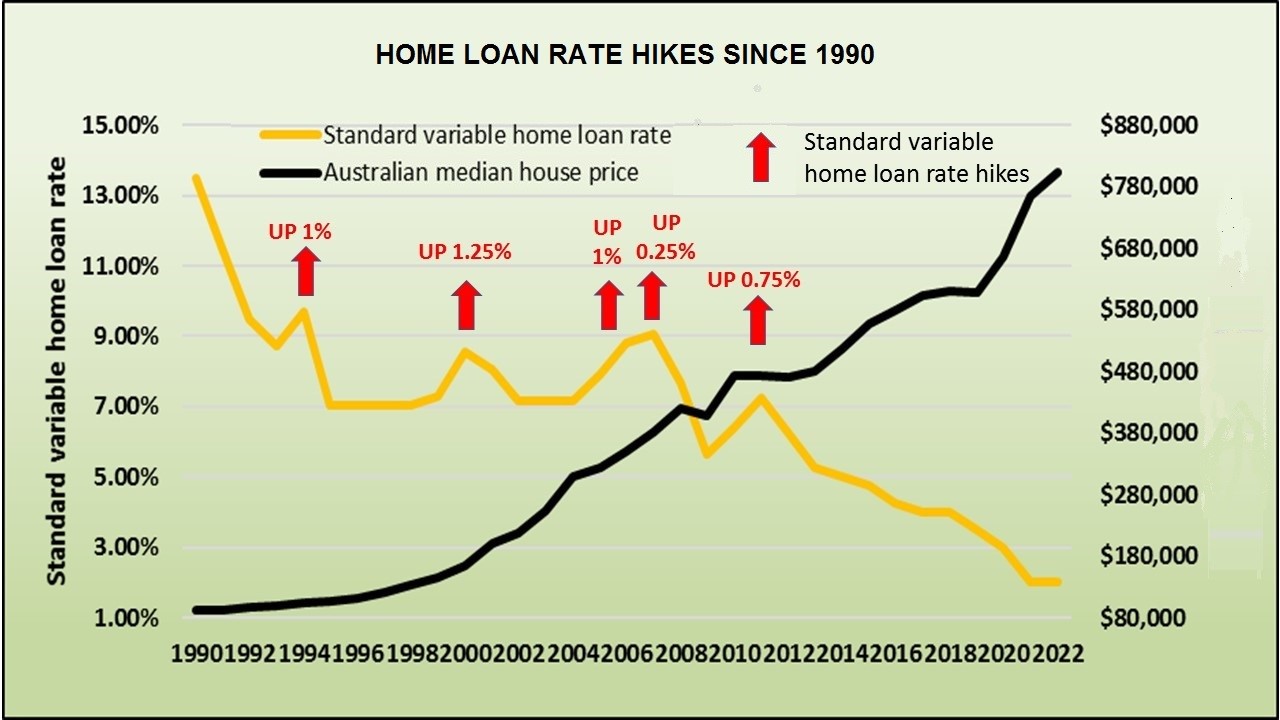

The major banks have lifted their standard variable home loan rates several times since 1990 and the last rises in the official cash rate ended over a decade ago in 2011. This graph shows you the change in the Australian median house price that took place after each group of rate rises occurred.

As the graph shows, house prices did not fall as a result of interest rate rises. It is possible, of course that property prices might have increased more quickly if interest rates hadn’t gone up when they did, but the point is that they did not fall. The simple reason for this apparent contradiction is that most of our property owners are immune from or resilient to the impact of interest rate rises.

Most of our property owners are immune from interest rate hikes

One-third of our housing is fully owned, with mortgages having been paid off and there’s no remaining debt.

One-third of our housing is fully owned, with mortgages having been paid off and there’s no remaining debt.

The owners are mostly older couples living in empty nests and when they sell, it will be to downsize. This means that interest rate rises are of no concern to them.

Another third of our housing stock is owned by investors who can claim the cost of housing finance interest against all their other income. This means that interest rate rises reduce the amount of income tax they pay. In addition, they can also raise asking rents on their properties to recoup the cost of any interest rate rises.

Only one-third of our residential properties have mortgages that are being paid off by owner-occupiers. Most of them, however, purchased their homes many years ago when rates were much higher than they are now. Their financial situations have improved since then and they have probably paid down some of their debt, so a rise in interest rates is quite manageable and does not motivate or force them to sell their homes.

Only first home buyers are badly impacted when interest rates rise

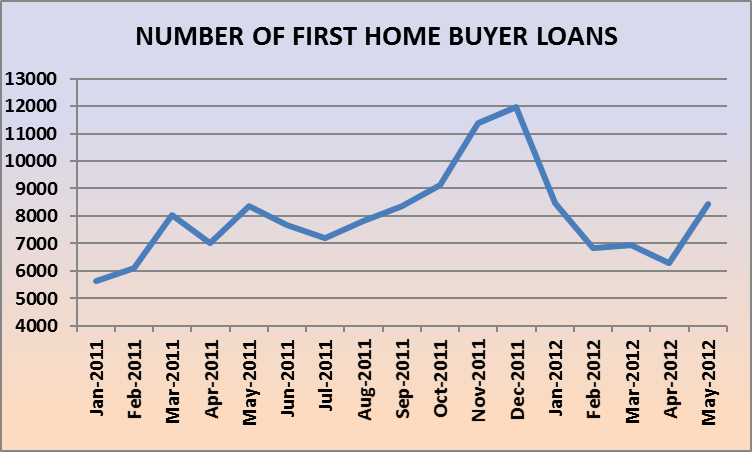

Higher interest rates impact the purchasing power of potential first home buyers more than other property buyers because they need to borrow most of the purchase price. This graph shows how the number of first home buyer housing finance loans fell in 2012 after the last succession of interest rate rises took place.

Some highly leveraged recent first time buyers in new outer suburban first home buyer areas may experience mortgage stress when interest rates go up. If enough of them are forced to sell for personal, family, financial or employment reasons and the number of potential first home buyers also falls, there is a risk that property values in first home buyer locations may fall.

First home buyers only comprise around one tenth of all home owners, and despite the personal and social impact of such events when they have occurred in the past, local markets have always bounced back into growth within a few months. Yet there have been several times in the past when our housing market as a whole has fallen in value and this suggests that there must be another cause.

Housing prices fall when the amount of housing finance is restricted

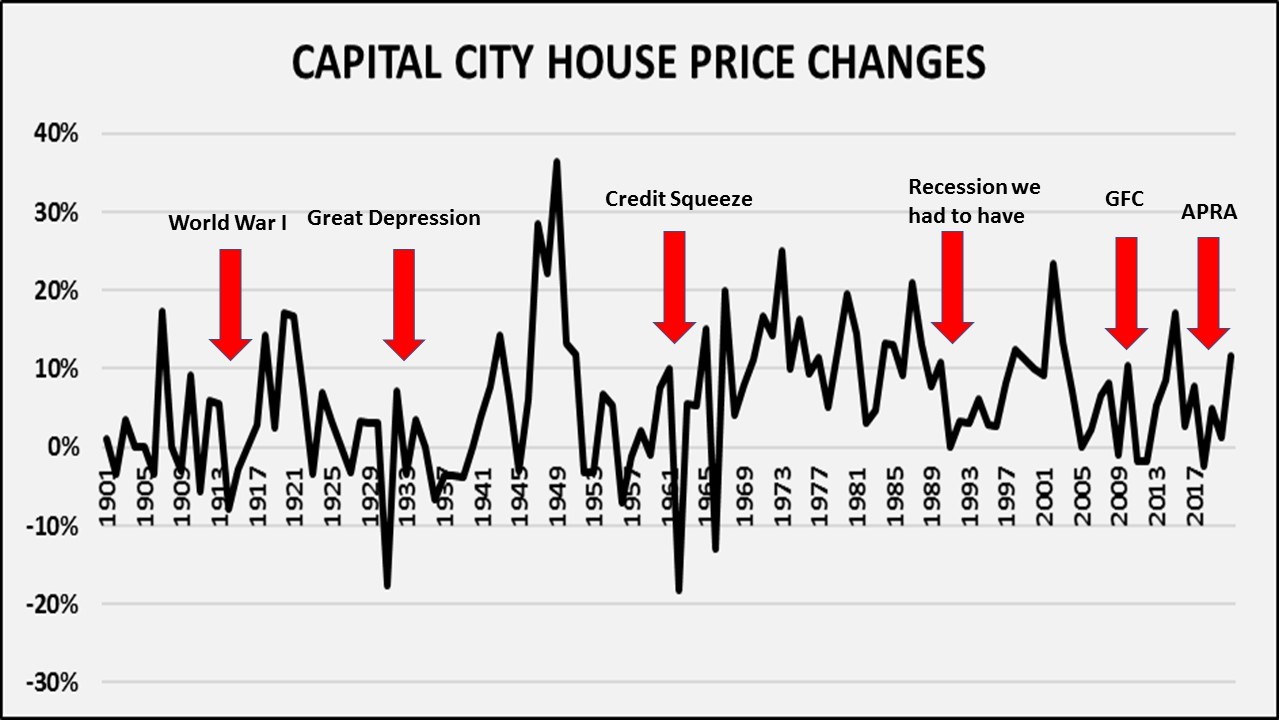

This graph shows annual Australian capital city house price changes from 1901 to the present. The red arrows indicate years when house prices went negative, and property owners experienced a fall in the value of their dwellings.

The only times when housing prices went backwards were during the First World War, the Great Depression, the Sixties Credit Squeeze, the Recession “We had to have”, the Global Financial Crisis and most recently, as a result of APRA restrictions on the amount of housing finance that investors could obtain from the banks.

Each of these events was a recessionary crisis that severely cut the amount of housing finance that was available to property buyers. Unlike interest rate rises, which may impact only around ten percent of property owners, a lack of housing finance affects all potential first home buyers, upgraders and investors, who together make up two-thirds of our housing market.

This is why house prices don’t fall when interest rates rise, but when there’s not enough housing finance available to potential buyers.

The aim of interest rate rises is to curb inflation, not hit housing prices

Interest rate hikes are a broad brush tool that the Reserve Bank uses to slow down inflation. The graph shows past groups of rate rises and how this tactic has worked in the past. It’s the reason why interest rates will increase again if the rate of inflation grows.

Because rising interest rates only impact a small percentage of home owners, we should look at the reason that they are increased, which is to slow down the rate of inflation. Is there a link between rising inflation and housing prices?

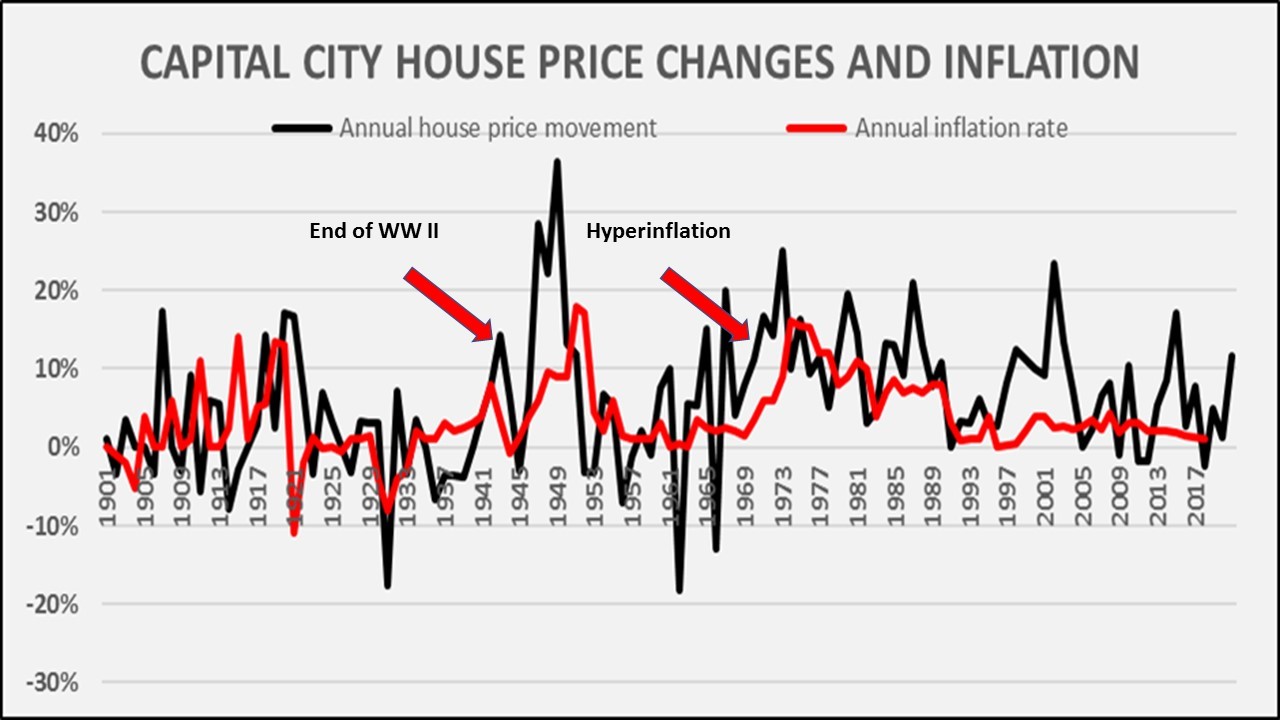

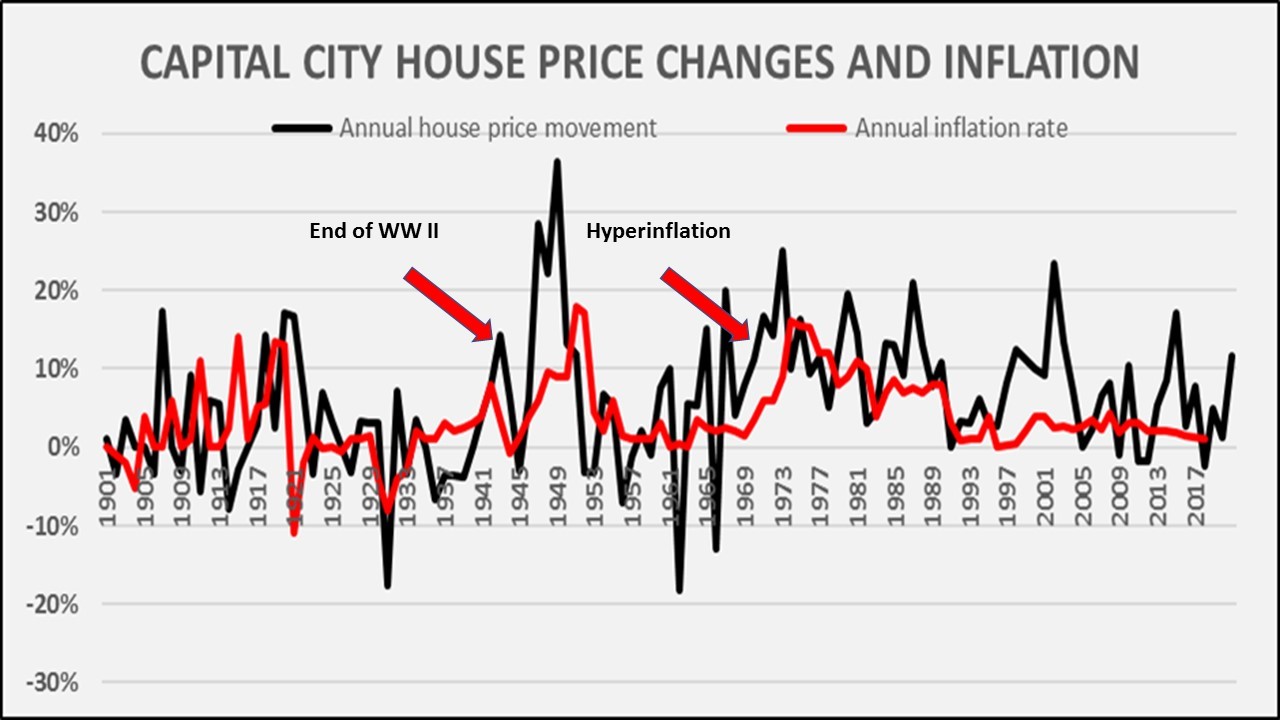

Housing prices have always moved in sync with the rate of inflation

This graph shows the relationship between capital city house prices and inflation from 1901 to the present time and demonstrates that housing price movements and inflation have always been in sync with each other.

In fact, as the graph also shows, housing prices have historically tended to move more vigorously than inflation rates but always in the same direction.

In addition, the graph demonstrates that during periods of rapidly rising inflation such as the post-war years and the seventies hyperinflation years, housing prices experienced their most dramatic price growth in our history.

In summary, it is clear that interest rate rises only impact a small percentage of property owners, while property prices on the whole rise whenever the rate of inflation increases. If inflation goes up this year or next, so will property prices.

.................................................

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

Visit Lindeman Reports for more information.

He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts.

John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report.

John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

To read more articles by John Lindeman, click here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.